As we approach 2026, we see reasons for optimism. The economy has accelerated past a period of tariff-related uncertainty. Federal Reserve rate cuts could broaden economic growth and benefit a wider range of companies. And we believe powerful secular trends that have driven economic growth and market gains remain intact.

Yet the U.S. large-cap growth landscape could be entering a new phase. After a period dominated by a narrow set of mega-cap leaders, we believe the market is poised for greater differentiation among winners and losers.

The AI theme is evolving: Which companies will endure?

AI will likely remain a primary market force driving performance in 2026. Demand for AI cloud-based workloads continues to accelerate, stimulating rapid investment in AI infrastructure by hyperscalers like Amazon, Microsoft, and Google.

We are starting to see revenue-generating opportunities move beyond infrastructure companies to the application layer. We anticipate advances in productivity as companies across industries integrate AI into core offerings, from workflow automation to specialized industrial applications.

But we also see that the initial wave of blanket AI enthusiasm is shifting toward discernment. The central question is no longer if AI will transform business, but rather which companies will emerge as lasting winners.

Different competitive dynamics are also emerging. Consumer-facing companies like OpenAI face growing competition and have committed to substantial spending programs. Enterprise-focused players like Anthropic, meanwhile, are gaining traction through API services and strong performance in areas like coding applications. Meanwhile, the largest technology companies are competing more directly with one another as their traditional boundaries blur.

As we move into 2026, we will be watching to see if early movers maintain their advantages or follow the path of first-generation internet companies that ultimately lost ground to later entrants. For investors, this means identifying companies with durable business models, clear paths to monetization, and sustainable competitive advantages.

Another key focus will be monitoring cloud adoption and how massive capital investment in cloud infrastructure translates into revenue growth and profit margins for hyperscalers. This relationship will largely determine value creation across the sector in the coming year.

A bifurcated market creates opportunity

The market is strikingly bifurcated from a valuation perspective. A handful of the largest companies command significant index weight and trade at premium multiples, while much of the broader market trades at compressed multiples. This has created a pool of potential opportunities in high-quality companies we view as overlooked or unduly penalized.

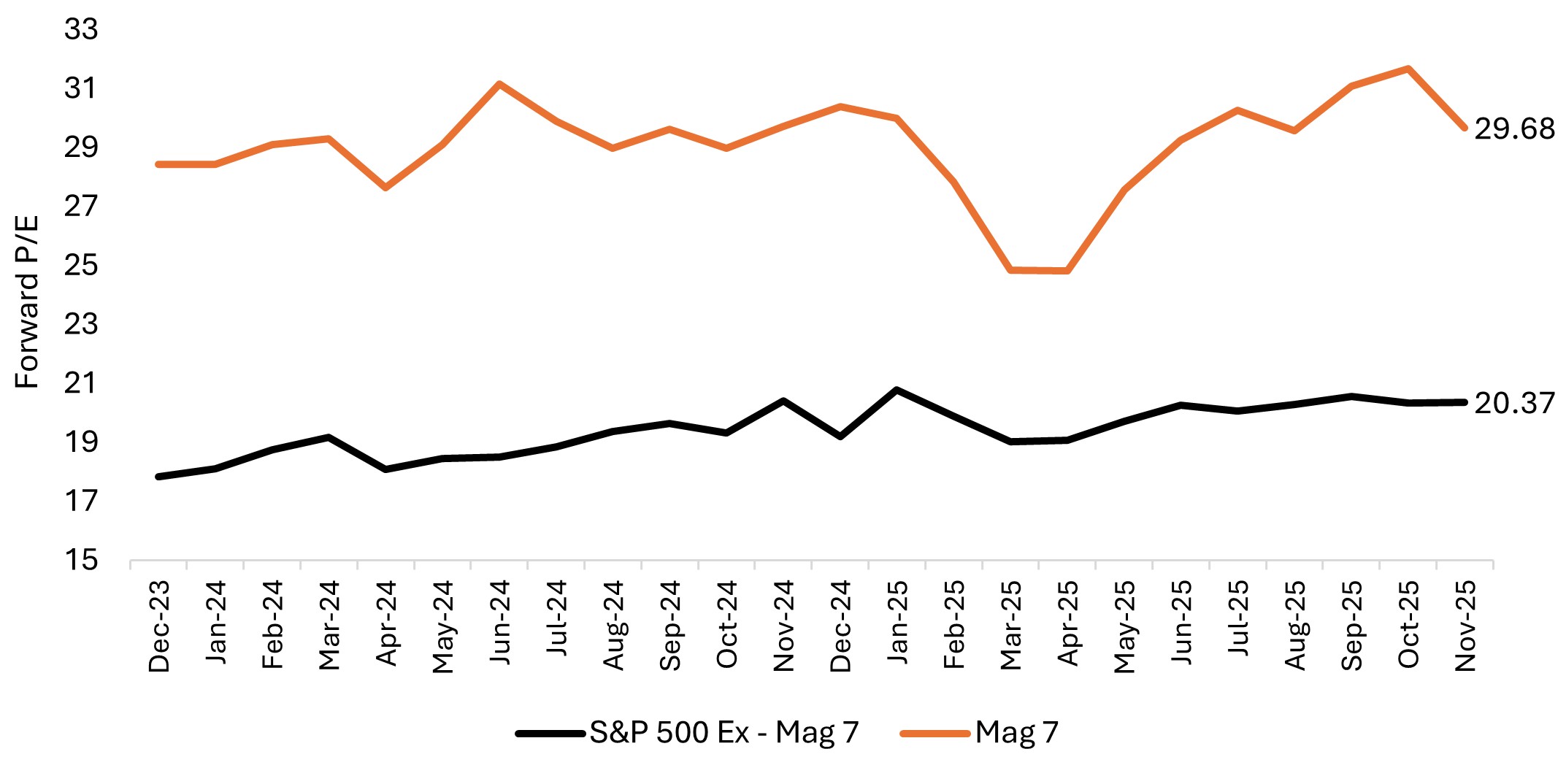

Exhibit 1: Forward 12-month P/E ratio, Mag 7 vs. S&P 500 ex-Mag 7

The valuation difference between the largest names (Magnificent 7 – orange line) and the rest of the market (S&P 500 Ex-Mag 7 – black line) is significant.

Source: Bloomberg, as of 30 November 2025. Forward 12-month P/E on blended forward basis.

In this environment, research and selectivity matter. We see potential in areas like software and certain consumer-facing companies where spending concerns have pressured prices. Some of these names are trading at their cheapest valuations in many years.

Longer-duration growth drivers continue to create compelling opportunities across healthcare innovation, AI infrastructure, and the digitization of commerce, payments, and advertising. We also see opportunity in power management companies benefiting from the surge in data center construction. Reshoring is another secular trend driving new investments in domestic manufacturing for semiconductors, pharmaceuticals, and other industries.

Companies aligned with secular trends have the potential to compound growth and gain market share across economic cycles. The key is separating companies with durable competitive advantages from those whose growth trajectories are slowing.

Risks worth monitoring

Two factors warrant particular attention as we move through 2026. First, we continue to closely monitor the trajectory of inflation. Consumers have become increasingly price-sensitive, and the path of interest rates hinges on whether inflation continues its downward glide or reverses course. So far, consumer spending has remained resilient, especially for upper-income households benefiting from asset appreciation and wage growth that has outpaced inflation.

Second, geopolitical uncertainty and trade policy remain fluid. Headlines around tariffs have moderated recently, but the potential for abrupt policy shifts creates an environment requiring constant vigilance. These macro factors could quickly reshape sector dynamics and impact relative performance.

Taking a broader view of growth themes

Our focus remains on identifying companies genuinely driving economic growth. With just a handful of true growth engines in the global economy, we believe exposure to the right businesses matters more than broad market participation.

With nine names currently representing approximately 60% of the Russell 1000 Growth Index, concentration risk becomes a real concern. The broad indexes are not risk-free and, in our view, are becoming less reflective of the underlying economic dynamism.

The coming year is likely to see greater stock-specific performance as AI matures, infrastructure spending faces the revenue test, and valuation gaps create opportunities in overlooked segments. For investors willing to be selective and avoid index concentration risks, this is a potentially compelling environment.

The evolving nature of secular growth themes, particularly AI, highlights the importance of active management. By taking a broader view of themes driving growth in U.S. large-cap equities, we see an opportunity to diversify AI-centric portfolios and address excessive market concentration.

IMPORTANT INFORMATION

Actively managed portfolios may fail to produce the intended results. No investment strategy can ensure a profit or eliminate the risk of loss.

Artificial intelligence (“AI”) focused companies, including those that develop or utilize AI technologies, may face rapid product obsolescence, intense competition, and increased regulatory scrutiny. These companies often rely heavily on intellectual property, invest significantly in research and development, and depend on maintaining and growing consumer demand. Their securities may be more volatile than those of companies offering more established technologies and may be affected by risks tied to the use of AI in business operations, including legal liability or reputational harm.

Concentrated investments in a single sector, industry or region will be more susceptible to factors affecting that group and may be more volatile than less concentrated investments or the market as a whole.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Growth stocks are subject to increased risk of loss and price volatility and may not realize their perceived growth potential.

Price-to-Earnings (P/E) Ratio measures share price compared to earnings per share for a stock or stocks in a portfolio.

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market as a whole.