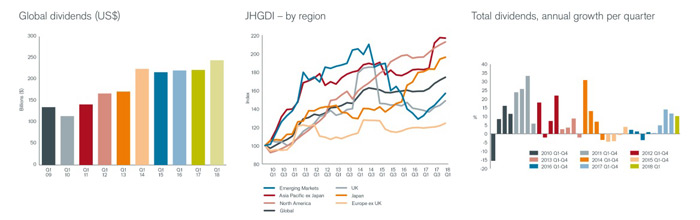

Growing corporate profits pushed global dividends 10.2% higher on a headline basis to $244.7bn in the first quarter, according to the Janus Henderson Global Dividend Index. The total was a record for the first quarter. All-time quarterly records were broken in Canada and the US, while first-quarter records were broken in one in four of the countries in the index. Asia Pacific ex Japan was the only region not to see an increase, owing to sharply lower special dividends in Hong Kong, and dividend cuts in Australia. The Janus Henderson Global Dividend Index ended the quarter at a record 174.2, meaning that global payouts last year were almost three-quarters higher than in 2009.

Key highlights

- Global dividends jumped 10.2% on a headline basis to $244.7bn in Q1, a record for first-quarter payouts

- Q1 exceeded expectations thanks to the weaker dollar; underlying growth of 5.9% met Janus Henderson’s forecast

- All-time quarterly records broken in Canada and the US; first-quarter records broken in one in four countries

- Asia Pacific ex Japan was the only region to see falling dividends due to lower special dividends in Hong Kong, and cuts in Australia

- 2018 set to see global dividend growth of 6.0% in underlying terms

- Headline growth upgraded to 8.5%, helped by a weaker dollar, with payments expected to reach a record $1.358 trillion

Source: Janus Henderson Investors

Q1 headline growth was ahead of Janus Henderson’s forecast, mainly because the US dollar weakened steadily over the course of the quarter, meaning that payments denominated in other currencies were translated at more favourable exchange rates.

On an underlying basis, growth was exactly in line with Janus Henderson’s expectations, up 5.9% year-on-year and continuing the pace set in 2017.

Seasonal patterns in dividend payments give North America a greater share of global payouts in Q1, as almost every company makes regular quarterly distributions to investors. US underlying growth was 7.6%, with the total paid reaching an all-time quarterly record of $113.0bn.

Overall, almost eight in ten US companies paid out more in dividends year-on-year, with technology, financials and healthcare doing best. Canada saw underlying growth of 13.8%, the fastest in the developed world. The $10.1bn total there was also an all-time record, and every company in the dividend index raised or held payouts.

Elsewhere, there are relatively few European dividend payments in Q1, and these were held back by a seasonal skew towards slower growing Swiss pharmaceutical stocks and oil companies. Underlying growth was 3.9%, though stronger European exchange rates pushed headline growth up 13.7%. Japanese payouts jumped 8.2% in underlying terms, the total reaching a first quarter record, while emerging market payouts were boosted by special dividends.

Asia Pacific ex Japan was the laggard during Q1. Payouts dropped 3.1% in underlying terms, though the dip is likely to prove temporary. Most companies in Hong Kong held or raised payouts modestly, though the headline total was hit by sharply lower special dividends, while Singaporean payouts were flat in underlying terms. Australian dividends fell due to cuts by two key Q1 payers, but behind the headlines, there was broad-based growth.

Janus Henderson has maintained its forecast for underlying dividend growth of 6.0% this year, with expansion expected to come from every region of the world. The dollar decline in recent months has added to the headline growth forecast and Janus Henderson now expect dividends to rise 8.5% in headline terms for the full year, reaching a total of $1.358 trillion, $10bn more than its initial expectations in January.

Source: Janus Henderson Investors

Ben Lofthouse, Director of Global Equity Income at Janus Henderson said: “2018 has started well for dividends. Economic growth is strong, and corporate profitability is rising, generating cash that companies can return to their shareholders. The Q1 acceleration in US dividend growth may be an early sign that companies are feeling confident about returning some of the cash they have accumulated to shareholders. Recent US corporate tax reforms could encourage this trend. The second quarter is seasonally important for European dividend payments and we will see a much broader range of industries and countries contributing than in Q1. Europe’s economic recovery is likely to yield healthy growth from across the region. Stock-specific problems in Australia made a greater impact on Q1 than they will on the full year, and we are optimistic for emerging markets and Asia too.

We’re confident investors will get to celebrate a new record for global dividends in 2018.”