Quarterly Update

Watch the investment team recap this quarter.

(Note: Filmed in January 2026).

About this fund

By taking a moderate approach to an asset class with potential for rapid growth, this mid-cap growth fund has demonstrated lower volatility than the index. Unlike many competitor products that focus on short-term growth rates, this strategy seeks to invest in companies that exhibit sustainable and durable growth.

Why invest in this fund

Smart Growth Approach

The Fund’s investment approach focuses on long-duration, sustainable-growth companies with strong competitive advantages and large addressable markets. We seek to avoid companies with rapid but unsustainable, short-term growth profiles.

Deep, Specialized Team

The Fund benefits from experienced Portfolio Managers with expertise in mid-cap investing; in-depth fundamental research conducted by a dedicated team of experts exclusively focused on small-mid-cap companies; and the broader support of an insightful team of equity investment professionals.

Growth Potential with Tempered Volatility

The Portfolio offers exposure to medium-size companies with resilient business models and is designed to weather a variety of market environments and take on moderately less risk than the index.

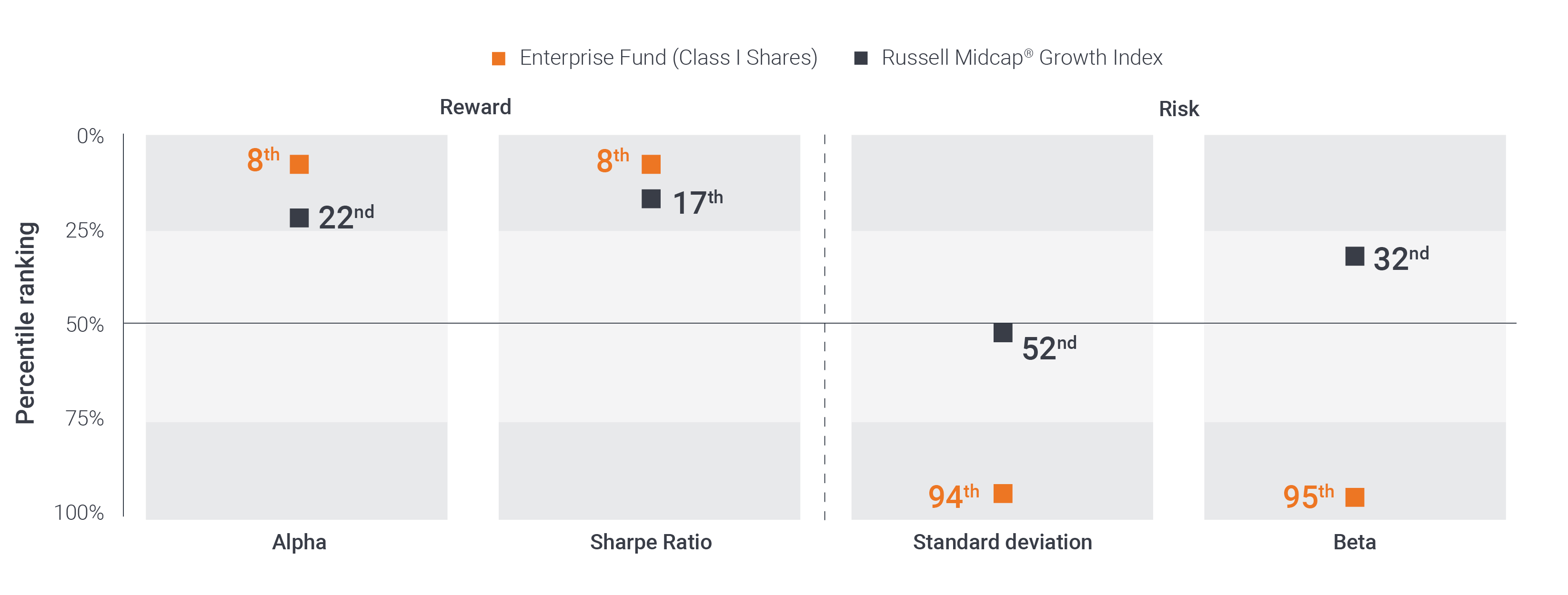

Strong risk-adjusted performance vs. peers

10-Year Rankings in Morningstar Mid-Cap growth category (441 funds) as of 12/31/25

Enterprise Fund 3-Year rankings in Morningstar Mid Cap Growth Category as of 12/31/25: Alpha – 38th percentile ranked 174 of 490 funds, Sharpe Ratio – 45th percentile ranked 216 of 490 funds, Standard Deviation – 92nd percentile ranked 455 of 490 funds and Beta – 92nd percentile ranked 447 of 490 funds.

Past performance is no guarantee of future results.