About this fund

Concentrated large-cap growth fund, leveraging our three decades of experience in high-conviction investing. By investing in our best wide-moat ideas, the Fund seeks to add excess returns over the long term. Given its concentrated nature, the Fund may exhibit moderately higher volatility than its benchmark.

Why invest in this fund

High-Conviction Approach

Fundamental research-driven approach, investing with conviction in 30 to 40 of our best large-cap growth ideas where we believe we have a differentiated view from the market.

Innovative Wide-Moat Companies

Seeks companies with sustainable competitive advantages that capitalize on their competitive moat to grow market share globally over a multi-year period. Emphasizes dominant companies driving innovation and change through disruptive technologies, products or business models.

Stock Selection Drives Return

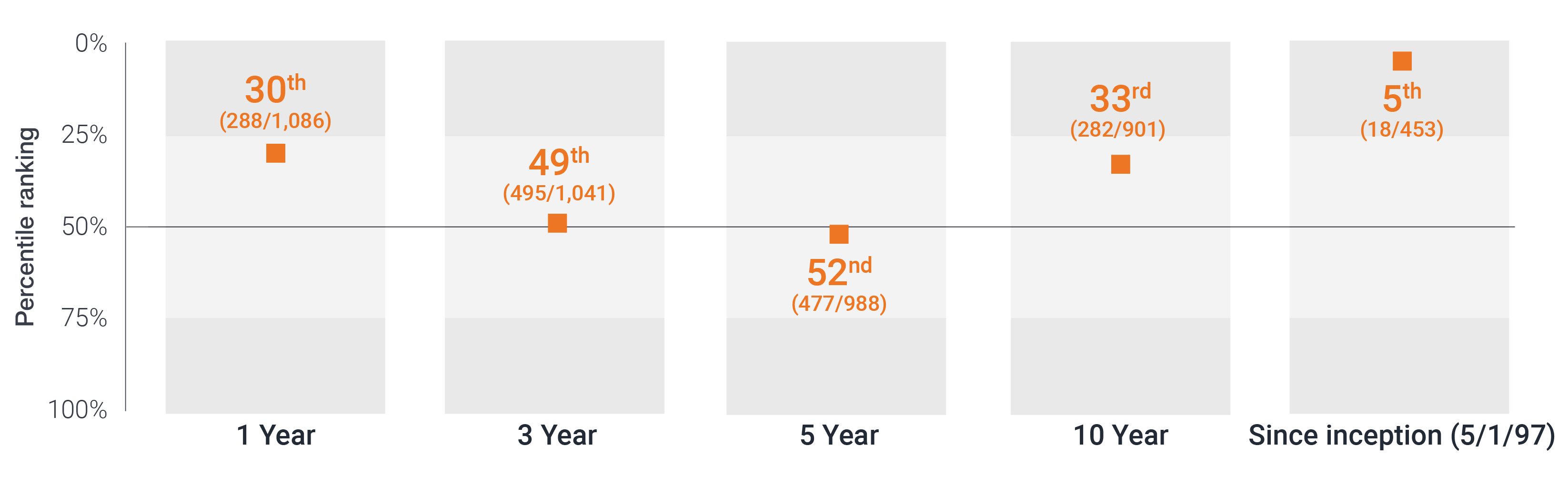

Stock picker’s fund designed to deliver long-term growth of capital with a high-conviction approach. Seeks to use risk wisely, leveraging our best ideas in a concentrated portfolio to drive potential outperformance of the index over time.

Active approach has delivered solid returns

Past performance is no guarantee of future results.