Investor Survey

2025 Edition: Retirement Income and Planning

How are high-net-worth investors preparing for the future?

We surveyed 1,504 affluent U.S. investors, aged 50 or older, to understand how they are preparing for and managing retirement income. Participants had a minimum of $250,000 in investable assets, with 44% of respondents holding $1 million+ in investable assets. The research was conducted in partnership with 8 Acre Perspective, an independent marketing research firm.

The results offer valuable insights into investor behavior, preferences, and planning strategies amid market volatility and evolving retirement needs.

Market volatility continues to be a test, and opportunity, for advisor relationships

Just under half of investors with a financial advisor reported that the level of communication with their advisor increased during the market volatility experienced earlier this year, and advisors who were proactive saw significantly higher levels of client loyalty.

Read more on page 2Comfort is king when it comes to retirement planning

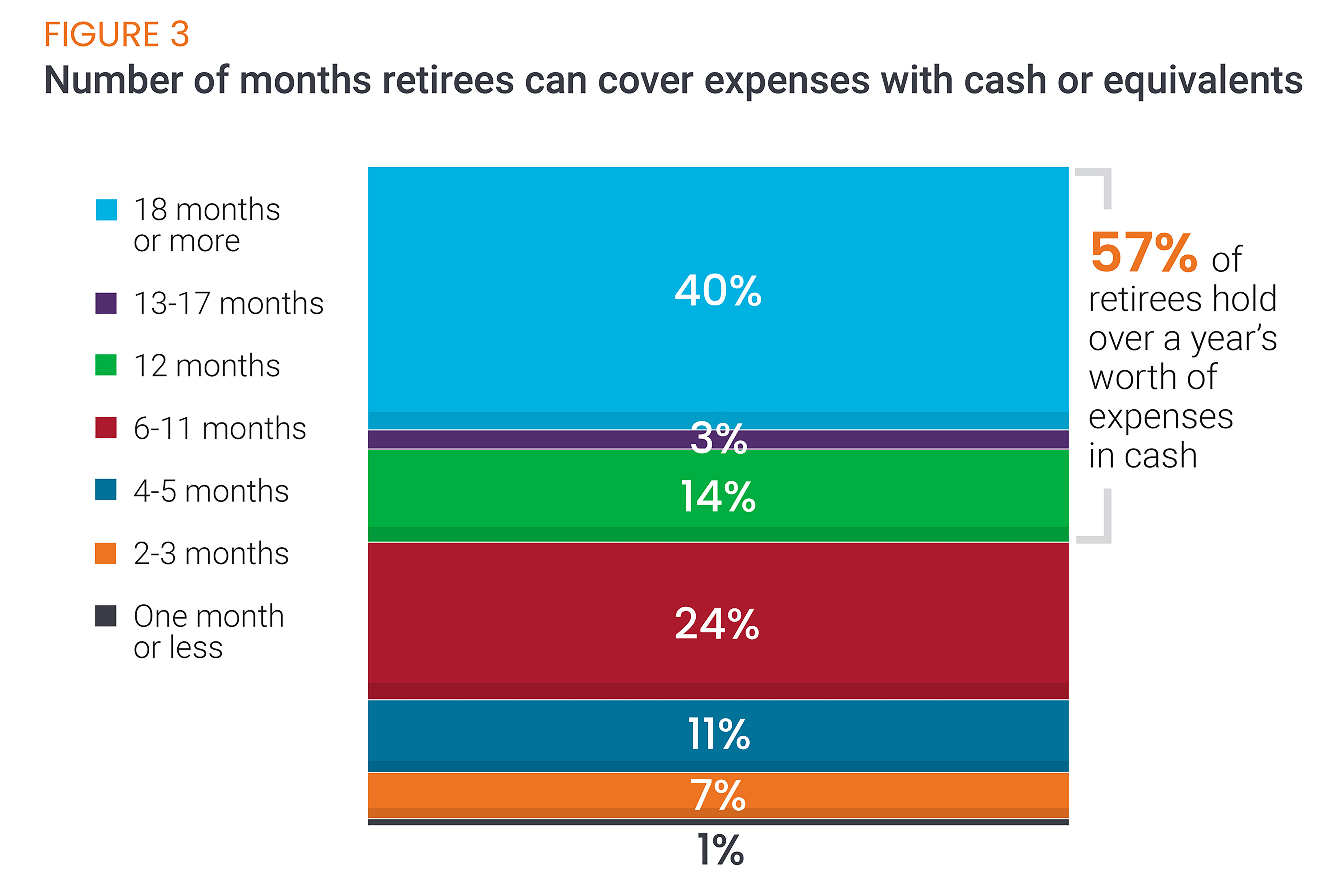

Financial peace of mind is clearly important as most respondents report holding a year's worth of expenses or more in cash. Investors' preferred retirement cash flow strategies reveal a comfort-first mindset, but also a potential need for deeper diversification conversations.

Read more on page 4Framing matters when it comes to retirement income

Small changes in how information is presented, or “framed,” can have a strong influence on client perceptions and decision making. Our findings provide insight into how advisors can reframe their client conversations to encourage desired behaviors.

Read more on page 6Insights

Looking for more?

Explore our 2024 Investor Survey where we sought to understand how the economic and political environment shaped financial attitudes, preferences, and behaviors.

Subscribe

Our latest thinking on themes shaping today's investment landscape, delivered every two weeks.