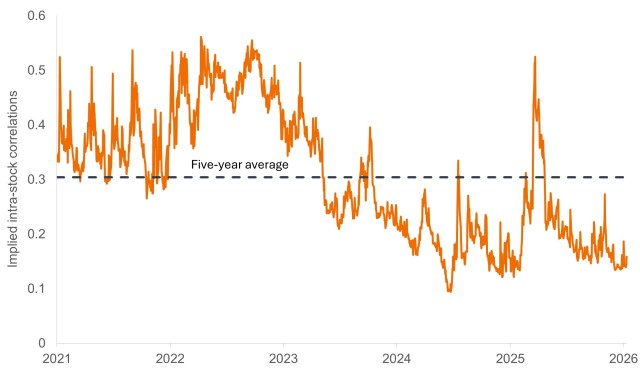

We view the lack of systemic risk priced into the market as the culprit for correlations among U.S. equities being near historic lows.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

While options markets indicate a relatively sanguine 2026 for equities, investors should take note of a potentially worrisome absence of systemic risk.

Signals embedded in forward-looking options markets indicate a relatively sanguine 2026 for both equities and fixed income.

Ali Dibadj explores key investment themes for 2026 to help actively position portfolios for resilience and growth.

Tokenization's potential to revolutionize investing.

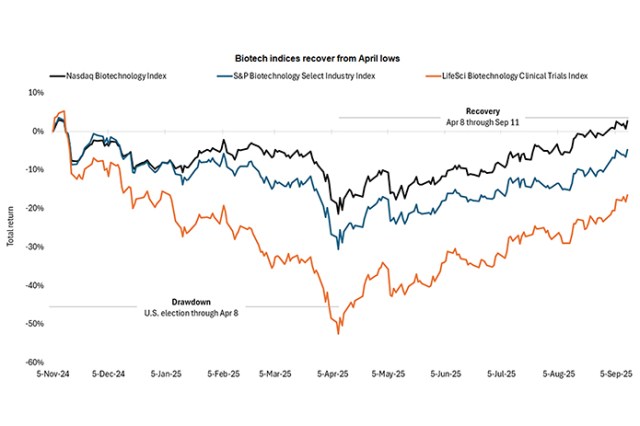

Optimism is returning to the biotech space, and we see durable drivers behind the recent performance recovery.

Ali Dibadj speaks with Victory Park Capital's co-founder Brendan Carroll about the successful integration of asset-backed private credit into portfolios.

Are shifting market dynamics building the need for real diversification in investors’ portfolios?

Modern investors tend to underappreciate the power of diversification across assets, time, and direction, which ancient societies, perhaps ironically, understood.

With Trump's tariffs reshaping global trade, our portfolio managers share insights on the longer-term implications for financial markets.

How much of a role can a liquid alternatives strategy play in a world of heightened geopolitical uncertainty, inflationary pressures, and dramatic changes in monetary policy?