Why Janus Henderson for multi-asset investing?

Janus Henderson’s global multi-asset platform delivers tailored strategies designed to help clients balance growth with income, all while seeking to mitigate risk across market conditions.

Our experienced investment professionals combine market assumptions and modeling, rigorous research, and global insights to build diversified solutions.

Global, multi-asset platform

Global, multi-asset platform

Broad investment capabilities leveraging the best of Janus Henderson, including our award-winning Portfolio Construction & Strategy service.

Adaptive multi-asset solutions

Adaptive multi-asset solutions

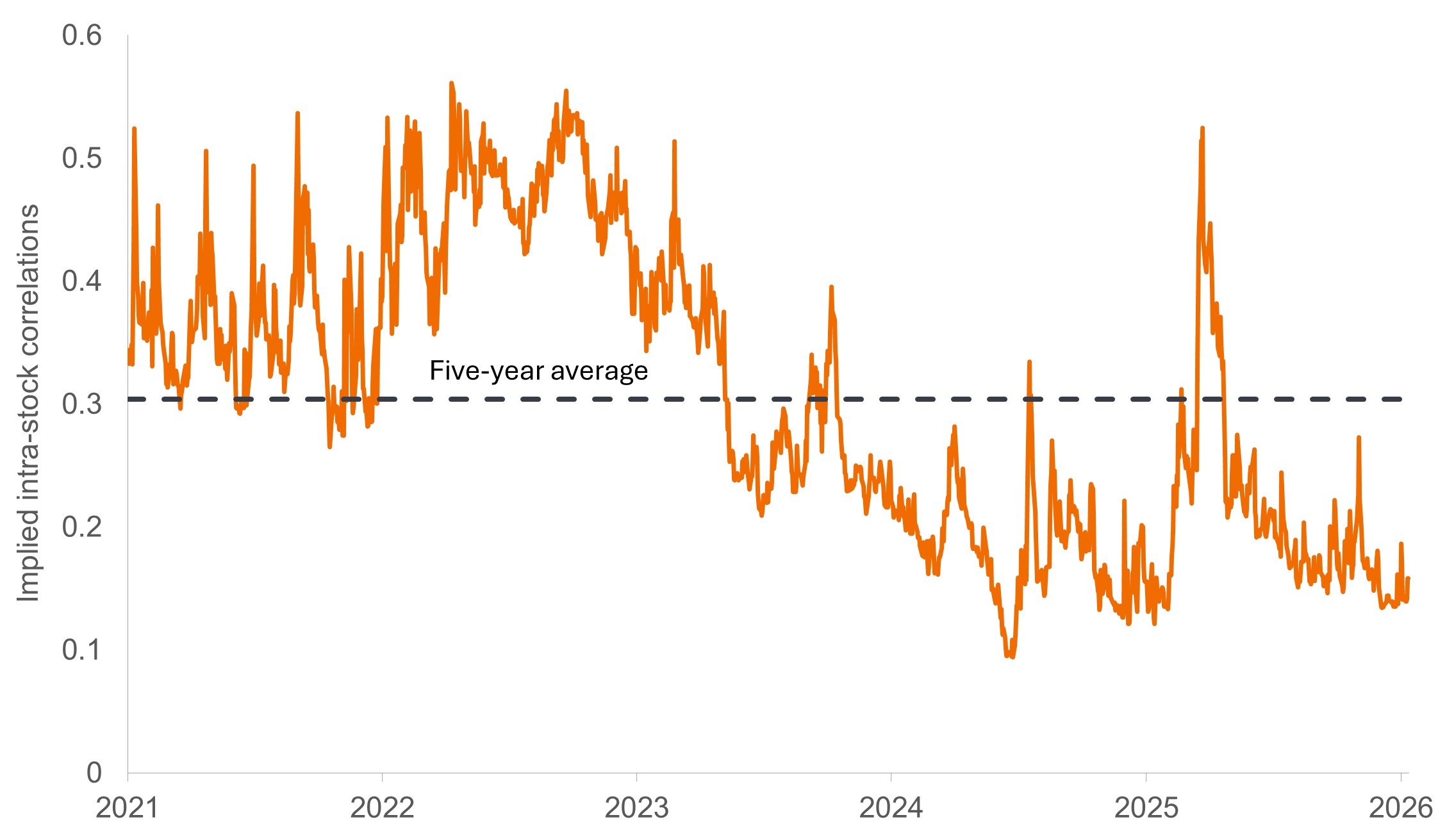

Informed by options market data, the adaptive platform seeks to enhance compound returns and manage downside risk across global stocks, bonds, cash, and commodities.

Collaborative multi‑asset expertise

Collaborative multi‑asset expertise

Our Multi-Asset Team offers a solutions-based approach, providing access to differentiated insights, disciplined investments, and world-class service.

Our multi-asset platform

Experienced asset allocators

Managing multi-asset portfolios on behalf of institutional and retail clients for more than 20 years.

£43.7bn

Multi-Asset AUM

15

Multi-Asset investment professionals

21

Average years' experience

As at 31 December 2025

Multi-Asset

Actively managed multi-asset portfolios designed to navigate market cycles.

Name

About this product

Multi-asset strategy implemented via active, passive and direct investments. A blend of strategic and dynamic asset allocation.

Differentiated insights

Insights delivered to your inbox

Receive timely perspectives on the themes shaping today’s investment landscape.