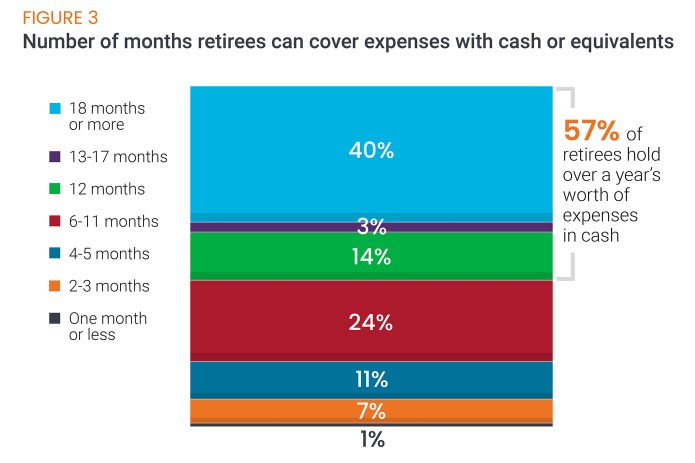

Many would look at the chart above and say that investors are being overly conservative and should diversify into assets that have a higher return potential to help meet their long-term financial goals.

While cash is generally not considered a viable long-term investment vehicle, it is important to understand why investors are opting for the comfort it represents. The main reasons include stability, accessibility, and ensuring that they will be able to generate sufficient cash flow in retirement.

Advisors may want to consider three action items for clients who have significant portions of their portfolio in cash:

1. It’s important remember that there is an emotional component to cash holdings. Clients who stay in cash are often feeling uncertain about something, whether in their personal lives or in the broader economy. Because of this, it’s critical for advisors to ask thoughtful, open-ended questions so they can understand clients’ feelings and help them navigate uncertainty without compromising their long-term goals.

2. Dividend-paying stocks are one area investors are considering: 39% of our survey respondents said they have already invested in dividend payers and 21% are planning to do so. This may be a good way to deploy cash in a way that allows clients to generate the income they are seeking.

3. Advisors should review clients’ retirement income plans given their current allocation and cash holdings. This exercise may help demonstrate to investors how they will be able to meet their income needs in retirement.

There is an important emotional component to cash holdings that advisors must be comfortable exploring with their clients. Advisors can provide valuable perspective on the risks of relying on cash as a long-term investment and help clients create a diversified retirement income plan.