Knowing that a large percentage of clients may be worried, advisors have an opportunity to proactively reach out to calm fears and shift the focus back to long-term goals.

Here are three topics to consider discussing during these interactions:

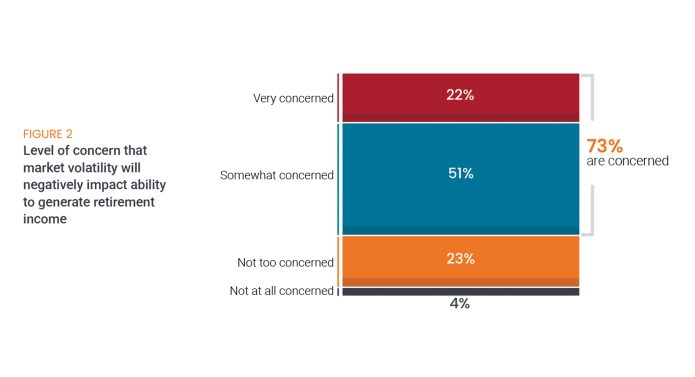

1. Conduct a review of the client’s retirement income plan. Given that market volatility may be causing investors to question their ability to generate adequate income, it may make sense to stress test the plan to show clients how it may be affected and come up with strategies for ensuring clients stay on track to their goals.

2. Show clients how the retirement income plan you’ve created will translate into monthly spending. Many times, clients focus too much on market performance rather than sustainable inflation-adjusted cash flows.

3. Use this research as a reason to proactively reach out to a client to see how they’re feeling. This may allow you to uncover concerns that weren’t previously known so you can help them manage emotions and avoid making irrational decisions. (Read more about the importance of investor psychology in our full Investor Survey.)

If we know what clients are worried about, we can then create strategies and plans that allay those near-term concerns while keeping investors on track to their long-term retirement income goals.