Subscribe

Sign up for timely perspectives delivered to your inbox.

As the era of easy money and low inflation comes to an end, Portfolio Managers Brian Demain and Cody Wheaton and Retirement Director Ben Rizzuto explain the implications for mid-cap growth stocks and plan menu due diligence.

Last year, we wrote of an emerging paradigm shift in mid-cap growth equities, set in motion by acute changes to the broader investment environment. As the market comes to grips with these changes, some excesses that we had warned of in the mid-cap space have eased. Now, as we look further out, we are evaluating the long-term implications for the asset class. We urge plan sponsors and advisors to consider these impacts and how they could affect plan lineups, participant allocations, and participant savings in the years ahead.

Mid-cap growth (MCG) funds are offered in numerous plan menu lineups. Recent analysis of the Brightscope database found that MCG funds were offered in 57% of plans. A comparable percentage (53%) was found via a similar review by PGIM.1 Target date funds and managed accounts, which serve as default investments for many participants, also allocate to mid-cap growth funds. Therefore, a significant amount of participant assets depends on the performance of these funds for their long-term retirement goals.

Powerful economic forces converged over the past 20 years to create a strongly deflationary environment. The economic opening of China, which joined the World Trade Organization (WTO) in 2001, led to the outsourcing of a tremendous amount of production, with inexpensive labor applying downward pressure on wages and diminishing the bargaining power of labor forces in the developed world. The rise of the Internet and its ability to provide price transparency to consumers further pushed down prices, as did the spread of other efficiency-enhancing technologies.

From a demographic standpoint, the baby boom generation entered the most productive years of their working careers, adding to productivity gains and saving capital. Finally, real (inflation-adjusted) commodity prices were negative for many material inputs. With the benefit of these deflationary forces, central banks were able to keep policy rates low for an extended period following the Global Financial Crisis (GFC), to stimulate growth. This backdrop created a rising tide that floated all risk assets, particularly long-duration growth stocks, allowing investors to pay a premium for cash flows very far into the future.

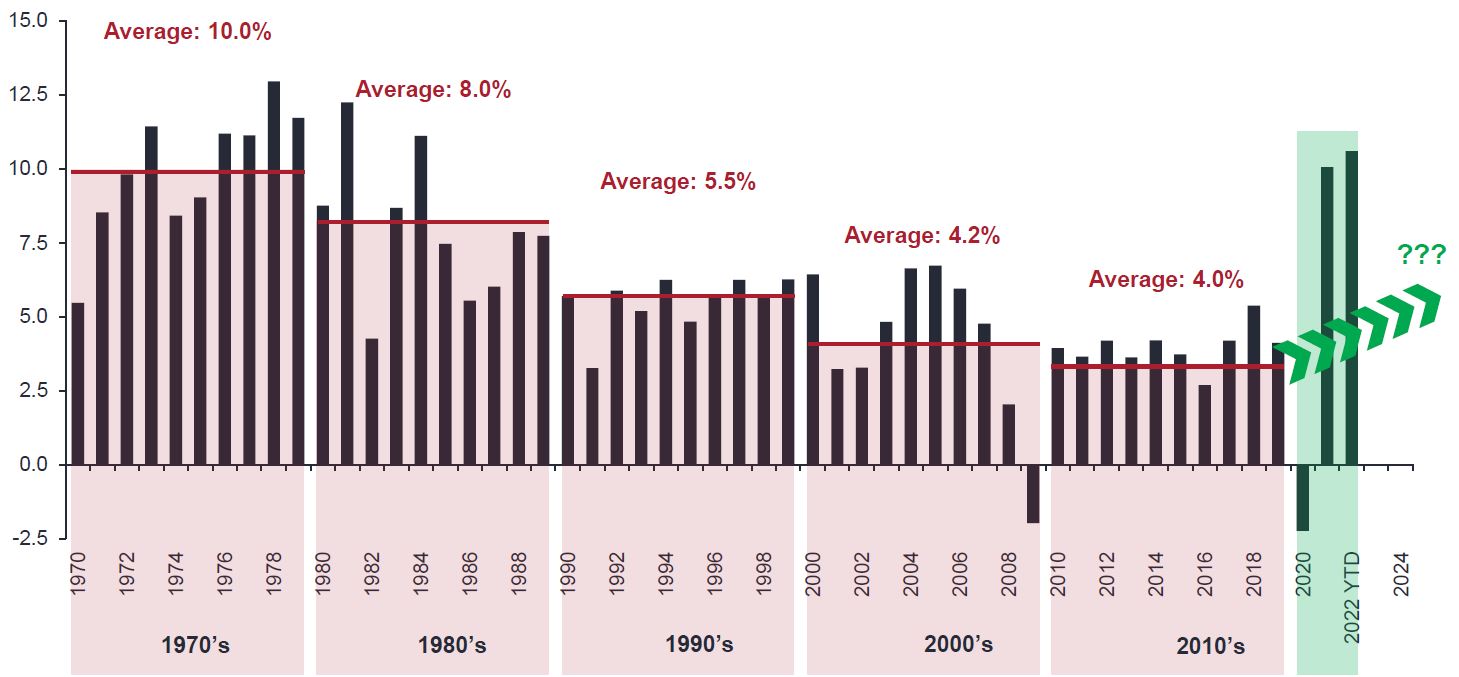

However, the onset of the COVID pandemic and the powerful fiscal and monetary response sparked far-reaching effects that have changed those deflationary tailwinds into inflationary headwinds by upending global supply chains and labor markets. Geopolitical tensions, including the trade war with China and the conflict in Ukraine, have created additional headwinds. The resulting inflation, which has been higher and more persistent than expected, has led to unprecedented global monetary tightening.

One can liken the environment to the megadrought that the Western United States are facing ‒ where water and capital were once plentiful, they are now becoming scarcer. Just as drought has produced erratic weather in the American West, tighter monetary conditions are creating intensifying bouts of volatility in financial markets. A reduction in water ravages the landscape while a scarcity of capital brings down puffed up valuations and index levels. The parched scenery has created unpleasant discoveries for investors who overpaid for unprofitable, speculative, and highly valued companies. Onlookers have observed with a mix of shock and, at times, denial. Those that remain anchored to expectations for an investment environment like the previous decade will likely be disappointed.

Supply chains broke down during the pandemic, and like the trade war before it, the war in Ukraine has forced companies to reconsider from where they are sourcing their materials and producing products. The return of unionization, increasing political populism, and a global shortage of labor have returned power to workers, placing upward pressure on labor costs. Meanwhile, baby boomers have now begun to exit the high-productivity saving period of their careers.

Source: U.S. Bureau of Economic Analysis, Janus Henderson Investors analysis, as of December 31, 2022.

Source: U.S. Bureau of Economic Analysis, Janus Henderson Investors analysis, as of December 31, 2022.

As these forces shift, we are likely facing a world of generally higher inflation, higher nominal GDP growth, higher rates, and – importantly – more volatility around these metrics than we have seen in recent history.

This paradigm shift and the uncertainty it brings could play out in the retirement plan accounts of participants who have enjoyed strong growth over the past several years via MCG and other asset classes. The drought we are now seeing in MCG could lead to smaller potential returns, more volatility, and the discovery that retirement assets may not grow sufficiently to meet one’s retirement goals. Therefore, it may be in the best interest of plan sponsors to find MCG funds that have the potential to weather this new paradigm, provide a less volatile experience, and help participants stay invested over the long term.

That consistency is especially noteworthy coming out of the height of the COVID pandemic. Research has found that, during 2020, participants who shifted allocations to become more conservative underperformed participants who did not make significant shifts by 750 bps.2 Those allocation shifts were most likely due to emotional decisions made during a period where investors endured volatility and a bear market.

Based on this paradigm shift, we believe that a fiduciary’s ongoing due diligence process can be enhanced to help ensure that MCG funds will meet plan and participant needs in the future. As we’ve noted in the past, it may be time for investment committees to become more familiar with in-depth investment statistics or lean on their plan advisors to provide such analysis. While prudent in any investment environment, we think a focus on the following factors will be especially important given the changing landscape and the potential for heightened volatility:

Following a significant reset in interest rates, valuations have settled at more reasonable levels, but now investors must focus on the macroeconomic picture and the potential impact on company earnings.

Firms with sustainable competitive advantages should be able to withstand inflation and competition while maintaining growth and profitability over the long term. But, while some competitively advantaged companies trade at a premium, their positioning can erode over time, shrinking their addressable opportunity. Furthermore, every company faces different unit economics, or the cost to gain a customer measured against the value or profit generated from acquiring that customer. While some companies spend significantly to acquire customers and gain valuable market share, investors should evaluate those costs against the returns they generate over the long term, seeking companies with unit economics that are reasonable and understandable.

Equity compensation, popular in many high-growth companies, is another area to monitor closely. If not properly accounted for, it can artificially inflate valuations and cash flows. As companies mature, growth slows, and the focus on bottom-line earnings increases, firms with significant noncash compensation may see their values decrease.

We believe in a “smart growth” approach in the mid-cap growth space, with a focus on sustainable growth companies that can thrive in a variety of environments while generating high return on invested capital (ROIC), as opposed to momentum companies with less sustainable long-term drivers.

Mid-cap growth equities tend to be underutilized in allocations relative to other asset classes and can offer significant growth potential with more organizational stability than smaller companies. Because of this, they should continue to play an important role in retirement plan menus and participant allocations.

Through patience, consistency, and the power of compound growth ‒ while moderating risk through reasonable valuation and fundamental strength ‒ mid-cap growth investors may be able to position their portfolios for a shifting paradigm.

1 Source: “Rebalancing 401(k) Core Menus to Make Them Retirement Ready”, David Blanchett, PGIM DC Solutions, January 26, 2022.

2 Source: Velasquez, Diana. “Keep Keeping Your Distance: An Updated Look at 401(k) Participant Behaviors During the COVID-19 Crisis.” Morningstar, Inc. April 1, 2021.

Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Monetary policy: The policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.

Quantitative Tightening (QT) is a government monetary policy occasionally used to decrease the money supply by either selling government securities or letting them mature and removing them from its cash balances.

Return On Invested Capital (ROIC) is a measure of how effectively a company used the money invested in its operations.

Volatility measures risk using the dispersion of returns for a given investment.

IMPORTANT INFORMATION

This information is not intended to be legal or fiduciary advice or a full representation of all responsibilities of plan sponsors and financial professionals.

Smaller capitalization securities may be less stable and more susceptible to adverse developments, and may be more volatile and less liquid than larger capitalization securities.

Growth stocks are subject to increased risk of loss and price volatility and may not realize their perceived growth potential.