Imagine this: After decades of diligent saving and careful financial planning, your clients – let’s call them Janet and Tom – are finally stepping into retirement. They’ve looked forward to this phase of life for years, envisioning leisurely mornings, travel adventures, and more time with family. However, as they sit down to discuss their retirement plans with you, Janet and Tom can’t shake a lingering anxiety. Despite having a solid nest egg, they’re plagued by a fear common to many retirees: the fear of running out of money.

Janet and Tom’s concerns aren’t unique. Retirement should feel like freedom, yet for many, it feels like stepping into the unknown. The transition from a steady paycheck to living off savings can be daunting, especially when you factor in market volatility and rising healthcare costs.

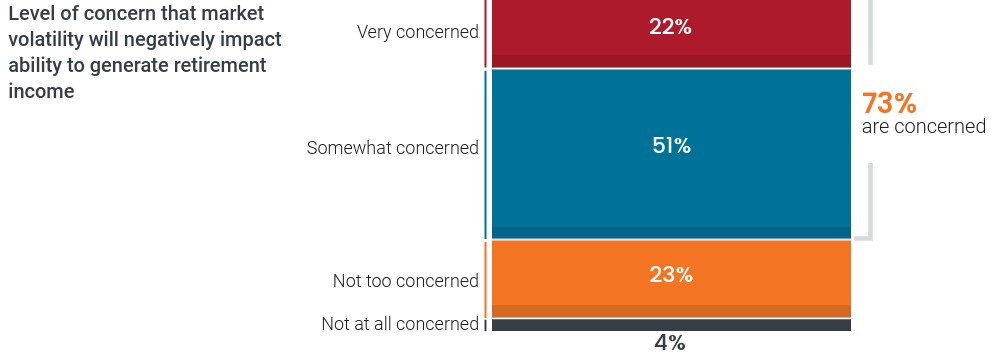

In fact, Janus Henderson’s 2025 Investor Survey on Retirement Income and Planning revealed that 73% of affluent investors worry about generating enough income in retirement. This anxiety can lead to overly cautious spending, a diminished quality of life, and even strained relationships.

The advisor’s role as psychological guide

As a financial advisor, your role extends beyond crunching numbers; it’s about guiding clients like Janet and Tom through a transition that is psychological as much as financial. And this isn’t just a math problem; it’s a mindset challenge. You’re tasked with helping clients shift from a mindset of accumulation to one of sustainable enjoyment.

In the following sections, we’ll explore how you can empower your clients to move from fear to confidence. By normalizing their concerns, clarifying their purpose, and coaching them through emotional triggers, you’ll help clients embrace the retirement they’ve worked so hard to achieve. Whether it’s addressing healthcare anxieties or reframing financial conversations, these strategies will equip you to offer both financial and emotional reassurance.

1. Normalize the fear. Start by acknowledging that this fear is normal. Clients have spent decades accumulating this wealth, and now they’re facing the prospect of spending it—a shift that often feels unnatural. To reassure clients, use empathy:

- Say: “Many retirees feel this way. You’re not alone, and we have strategies to help.”

- Avoid dismissing concerns with technical jargon. Instead, validate emotions before introducing solutions.

Integrating insights from behavioral finance research can further reassure clients, showing them that these fears are common and manageable. For example, a recent study showed that nearly half of America’s retirees (46%) say spending their retirement savings creates anxiety.1 As a result, many retirees underspend despite having the means.

2. Help clients define their “Why”. Purpose creates clarity and helps us overcome fears that are often rooted in uncertainty. To help clients gain clarity around their retirement goals, encourage them to create a Financial Purpose Statement. This statement serves as a guiding compass, defining the role of money in their post-work life and aligning financial decisions with personal values and aspirations.

Examples of a Financial Purpose Statement might be:

- “To maintain independence and enjoy meaningful experiences with family.”

- “To live comfortably while supporting causes I care about.”

This exercise redefines money as a tool for living, not just a number to protect. When clients see spending as aligned with their values, they feel more confident and less guilty.

3. Reframe the conversation. Language matters. Instead of talking about “success rates” or “failure probabilities,” consider using softer framing:

- Say: “Your plan is designed to adapt. If markets change, we’ll make small adjustments together.”

- Avoid: “You have a 90% chance of success,” which sounds like a test they could fail.

Research indicates that clients respond better when plans are framed as flexible spending adjustments rather than binary outcomes. This gives them a sense of control. In fact, our Investor Survey revealed that the way certain topics are “framed” can influence how clients process and respond to the information (a topic my colleague Matt Sommer recently explored in detail).

4. Focus on comfort, not complexity – Clients often seek comfort over optimization. Many retirees hold a year’s worth of expenses in cash because it feels safe. Instead of challenging this instinct, embrace it:

- Build a “comfort cushion” for near-term expenses.

- Reinforce that this is part of the plan, not a sign of weakness.

When clients feel secure about the next 12–18 months, they’re more willing to enjoy life without constant worry.

5. Address healthcare anxiety – Medical costs are a major source of fear for those nearing or in retirement. Instead of overwhelming clients with statistics, use reassurance:

- Say: “We’ve set aside funds for healthcare and long-term care. You’re prepared for the unexpected.”

- Frame the coverage you’ve established for these costs as peace of mind, not a looming threat.

- Consider providing visual aids, such as a chart showing how healthcare and contingency funds are allocated, to enhance understanding.

6. Coach through emotional triggers – Market volatility, headlines, and family opinions can trigger fear. Your role is to coach, not just calculate. To help clients cope with their emotions, try the following:

- Schedule regular check-ins to reinforce confidence, provide updates, and get a “pulse check” on how your clients are feeling.

- Use positive framing: “Your plan is working as intended.”

- Remind clients of their Financial Purpose Statement during stressful times.

- Behavioral coaching is about helping clients pause before reacting; sometimes, the most valuable advice is to “Do nothing.”

Helping clients overcome the fear of running out of money isn’t about spreadsheets—it’s about psychology. By normalizing their concerns, clarifying their purpose, and coaching them through emotional triggers, you empower clients to live the retirement they’ve earned.

As you continue to support your clients on their journey, consider these approaches as foundational elements that can help transform the fear of running out of money into the freedom to enjoy what they have worked so hard to achieve. Together, you can create a retirement experience that celebrates clients’ achievements, honors their values, and provides lasting peace and enjoyment.

1 Source: Alliance for Lifetime Income’s 2024 Protected Retirement Income and Planning (PRIP) Study.