Subscribe

Sign up for timely perspectives delivered to your inbox.

Wealth Strategist Ben Rizzuto explains why attracting clients of any age may start with offering a free financial plan.

We all like a good deal. Heck, as I’ve gotten older, my deal meter has gotten even more highly tuned – so much so that my daughter chides me by saying I have reached “peak dad status.”

A good deal is generally considered one where we feel we’re getting more value than what we’re paying. And the best deal of all, of course, is getting something of value for free.

As you read this, you may be sitting at a desk decorated with logoed items from all sorts of companies that you received for free at a conference or other event. Some of those items may have proven useful, others not so much. Either way, you probably appreciate the fact that they were free. (By the way, if you stop by the Janus Henderson booth for a pen at your next industry conference, don’t worry, it’s on me.)

Whether it’s a free pen at a conference booth or a free financial plan offered to a prospective client, the zero-cost of these items serves the same purpose: an enticement to start a conversation. And if that conversation goes well, the hope is that a relationship will develop.

While it’s questionable whether those free pens will lead to much, it turns out that a free financial plan might.

In our 2023 Wealth Advisor’s Guide, we highlighted research on the perceived value of free financial plans and how they might affect your practice’s bottom line.

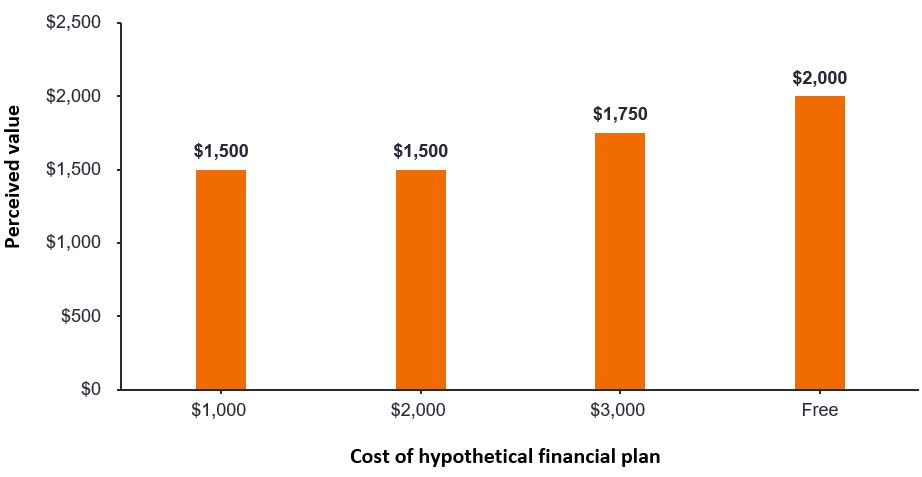

The study asked participants to envision a situation where they inherited $1 million and needed help managing it. They were then split into four groups where they would receive a financial plan costing either $1,000, $2,000, $3,000, or nothing. Finally, they were asked what they considered a reasonable annual fee for investment and tax-related services.1 As shown below, the average perceived value of those ongoing services turned out to be quite different than you may have thought.

Source: “How a free financial plan retains more perceived value than an average priced one.” Kitces.com, May 25, 2022.

Surprisingly, those participants who were part of a group that would receive a free financial plan thought that the value of ongoing financial planning services was higher than all the other participants.

The data shown above reflects the 50th percentile; however, when looking at the figures for the 90th percentile, we saw that those in the $1,000, $2,000 and $3,000 groups were willing to pay $10,000 – or 1% of the $1 million inheritance – for financial planning services, whereas those in the free group were willing to pay 1.35%.

Part of the reasoning behind these results can be attributed to a heuristic known as anchoring. The anchoring bias occurs when we rely too heavily on either pre-existing information or the first piece of information (i.e., the anchor) when making a decision.2 The $1,000, $2,000, and $3,000 groups were anchored to those dollar amounts. The free group, however, were not given a reference point, which allows them to focus more on the actual details and perceived value of the services.

Along with that, I feel that we as consumers understand that “free” is somehow different than other “introductory” costs. In other words, we know that no one is going to charge us zero dollars on an ongoing basis. Thus, in the end, as the researchers who conducted this study noted, “goods or services that are ‘free’ are not necessarily perceived as having lesser value.”

This research offers some valuable perspective on how advisors market their financial planning services to prospective clients. Specifically, it raises the question, if you’re currently charging prospects for an initial financial plan, should you consider offering it for free? Or if you are already offering a free introductory financial plan for prospective clients, should you consider being more overt in marketing these offers?

Lastly, free introductory financial plans may also be a great way to develop relationships with younger clients. It’s well documented that younger investors have a relatively negative view of the financial services industry and the “value” it provides, but we’ve also seen younger clients say they want and need help developing a financial plan. A free financial plan might be a more palatable way for them to consider a relationship with a financial professional. At the very least, I’d say it’s far more likely to entice them than a free pen.

IMPORTANT INFORMATION

The information contained herein is for educational purposes only and should not be construed as financial, legal or tax advice. Circumstances may change over time so it may be appropriate to evaluate strategy with the assistance of a financial professional. Federal and state laws and regulations are complex and subject to change. Laws of a particular state or laws that may be applicable to a particular situation may have an impact on the applicability, accuracy, or completeness of the information provided. Janus Henderson does not have information related to and does not review or verify particular financial or tax situations, and is not liable for use of, or any position taken in reliance on, such information.

1 Tharp, D. How a free financial plan retains more perceived value than an average priced one. Kitces. May 25, 2022.

2 “Anchoring Bias Heuristic & Decision Making: Definition and Examples.” Simplypsychology.org, February 2023.