In 2021, the CFP Board of Standards added “psychology of financial planning” as a Principal Knowledge Topic. The addition followed an extensive study that highlighted the importance of a financial advisor’s ability to diagnose and mitigate the emotional biases and cognitive errors investors commonly experience when making financial decisions.

Investor psychology has long been a focus of mine academically, and it’s a topic the Specialist Consulting Group here at Janus Henderson has explored in depth and incorporated into the wealth management resources we offer advisors.

In fact, I recently discussed how addressing the psychological aspects of financial planning can help advisors increase referrals. As I outlined in the article, there are several ways to incorporate investor psychology into your practice, such as pursuing online courses or hosting client education events. These are still good avenues to explore, but our latest Investor Survey uncovered an even simpler route to influencing investor behavior.

Specifically, the results revealed that the way certain topics are “framed” – through strategic phrasing and word choice – can influence how clients process and respond to the information. For advisors, this presents an actionable opportunity to address investor psychology by making subtle shifts in how they communicate with clients.

The survey: Three retirement income scenarios to assess investors’ mindset

Our online survey was conducted in June 2025, targeting individuals aged 50 or older with at least $250,000 in investable assets. The final sample size was 1,504 U.S. retail investors.

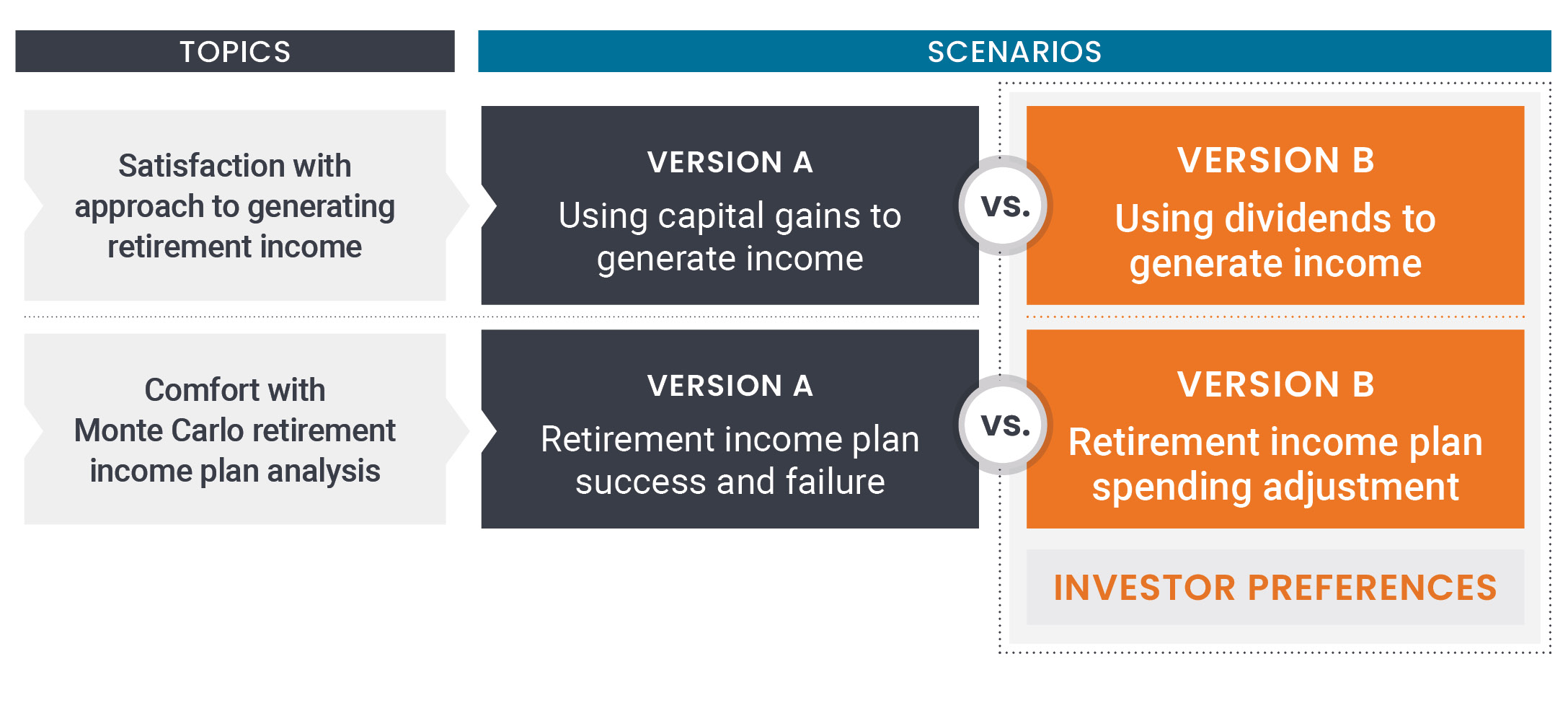

Participants were shown one of two versions of a question across three topics: dividends versus capital gains in retirement income planning, Monte Carlo Analysis results, and the timing of Social Security benefits. The results were then analyzed to determine how the framing of these topics influenced participants’ responses and preferences.

Based on our findings, following are some ideas on how advisors can reframe their client conversations on these topics to encourage better decision making and boost investor confidence and peace of mind.

Scenario 1

Capital gains vs. dividends: How do investors prefer to generate retirement income?

Since different forms of money are interchangeable, investors should be indifferent to how different sources of wealth fulfill their spending needs. But behavioral finance theories suggest that individuals tend to be more tempted (and less hesitant) to spend current income compared to current assets. This is because, through a process known as mental accounting, individuals assign a lower value to current income and a higher value to current assets.

Based on this tendency, it stands to reason that individuals would derive less satisfaction from spending income generated through a capital gain than they would from spending income received as a dividend payment, even if the amounts are identical. And indeed, our survey findings revealed a preference for using dividends to generate retirement income, versus using capital gains.

This preference is arguably something of a fallacy – that is, investors may lean toward dividends more for psychological reasons instead of monetary considerations. But that doesn’t mean advisors must disregard it. On the contrary, advisors should consider the non-financial benefits of investor comfort and peace of mind that including dividend-payers within retirement portfolios may provide.

Scenario 2

Monte Carlo analysis: Focus on spending adjustments, not failure vs. success

The Monte Carlo analysis is a popular and effective tool for presenting retirement income planning scenarios. But the way advisors typically frame the results may be working against them from an investor psychology perspective.

Advisors commonly frame the results around the success and failure rate of the analysis. But focusing on the likelihood of an outcome may leave clients feeling that they have little control over their future. That lack of control may make clients less inclined to adopt the habits and behaviors that can help them make progress toward their goals.

Our survey found that investors may be more comfortable with Montel Carlo analysis results when they are framed in a way that focuses on future spending adjustments rather than the odds of failure. Thus, a simple reframing in how advisors present these results could improve clients’ comfort levels and encourage them to make proactive adjustments in their spending as they work toward their retirement goals.

For more specific guidance around how to frame results, here is the phrasing used in our survey scenario:

You are told that you can expect a 90% chance of not having to make any spending adjustments. In other words, you will have enough money in retirement to meet your desired annual spending goal in 90% of market return scenarios. In the remaining 10% of scenarios generated, you will have to decrease your spending to avoid running out of money. These decreases may be small or large and may occur earlier or later in retirement, all depending upon market returns.

Framing scenarios and investor preferences Scenario 3

Scenario 3

When to take Social Security benefits: Receiving benefits early for a loss vs. waiting for a gain

With our final scenarios, we sought to determine how framing conversations on Social Security might influence investors’ decisions on when to start taking benefits. Specifically, in the first scenario, waiting to take benefits was framed as a gain, while in the second, taking benefits early was framed as a loss.

As expected, we found that respondents were more likely to recommend delaying taking Social Security when it was framed as a loss versus a gain – presenting an opportunity to reframe the conversation with clients who are nearing full retirement age.

Reframing this discussion requires little effort or training. Advisors can simply explain to clients that Social Security benefits are maximized at age 70, and for each year benefits are taken early, an 8% credit is lost (rather than pointing out that an 8% credit is gained for each year past age 67 receipt is delayed). This subtle shift may help clients more likely to resist the temptation to take benefits sooner. Which is important, considering that for most clients in good health and who have other financial resources to draw upon, delaying Social Security until age 70 can maximize total benefits received over their lifetime.

The role of investor psychology in retirement income planning

The overarching takeaway from our survey is that when it comes to retirement income planning, investor psychology should not be overlooked. Understanding and responding to clients’ behavioral tendencies – particularly their desire for comfort and peace of mind – is key to helping them make sound decisions. And as the findings from our scenarios illustrate, subtle shifts in how certain conversations are framed can go a long way toward keeping clients on track to their goals.