Q: It’s been an eventful year, with big swings in market performance. How do you view volatility, and what’s changed in the investment landscape?

A: We like when markets become emotional. That might sound counterintuitive, but in our view, volatility can often present opportunity. There’s a critical distinction that many investors miss: If you’re a long-term investor committed to owning a business for five, 10, or 20 years, short-term volatility can create attractive entry points into high-quality businesses.

That said, the market craves certainty and the noise around politics and policy have created concerns. What we’ve seen this year is that when uncertainty picks up, decision-making slows down across the market. Companies struggle with long-term fixed capital decisions, and even retail giants find themselves flying a little blind.

In terms of the overall investment landscape, the big shift we’ve observed year-to-date is that while the U.S. economy is doing fine, the macro tide is no longer lifting all boats. We’re in a more selective environment now. While AI-related companies remain supported by continued increases in estimates of future data center capital spending, it’s not all about the Mag 7 anymore; top contributors to the S&P 500® Index’s year-to-date performance also include names in financials and aerospace.

As the market broadens out, it’s creating more opportunities for investors who focus on individual company fundamentals rather than macro bets or thematic processes. This environment lends itself to active investing because one of the keys to picking winners is to identify value in places others might overlook.

Q: How are tariffs affecting companies, and how are you evaluating this risk?

A: A lot of our recent conversations with companies have focused on their tariff mitigation strategies. What we’re seeing is a mix of approaches – some substitution, some supply chain movement away from China where and when possible, and pricing increases. But retailers have to be very careful about how they adjust prices.

Many companies are focused on less noticeable items for price increases. For example, if you only buy a coffee maker once every three years, you’re much less sensitive to that price increase than you are to the dozen eggs you buy every week. So, the strategy for what to increase and by how much is important. The critical question for the remainder of the year is around the price elasticity of demand. That is, how much will unit demand contract as prices rise?

The busy holiday season for retailers is still ahead. There are tariffed goods coming in, some un-tariffed goods still on the shelves, and we know prices are going to go up. So far there have been no major calamities, but a lot remains to be seen, and investors need to stay alert as the tariff situation unfolds.

Q: How are you thinking about artificial intelligence (AI) and its investment implications?

A: Any discussion about growth investing must take AI into account, but as a research team, we’re perhaps talking about it a bit differently than most. We can appreciate why investors can myopically focused on a very small group of stocks – those selling into data center growth as a current example.

When we consider a generational theme such as AI, it’s important to think broadly across sectors and to have an investment process built to share insights. Within each of our sector teams, we’re constantly debating how AI will shift the competitive sands by creating victims and beneficiaries of disruption.

What’s happening today reminds some of us of the Internet in 1998 and 1999. Investors became obsessed with a relatively small number of darlings, but only a few of the stocks of the day turned out to be good investments. Yet the Internet ended up being orders of magnitude more impactful than anyone foresaw then. We think AI is going to follow a similar path as it simply permeates the fabric of the global economy.

The companies that may benefit the most aren’t necessarily the obvious AI players; rather, they’re the companies that can effectively integrate AI to improve their business models, reduce costs, enhance customer experiences, or create entirely new revenue streams.

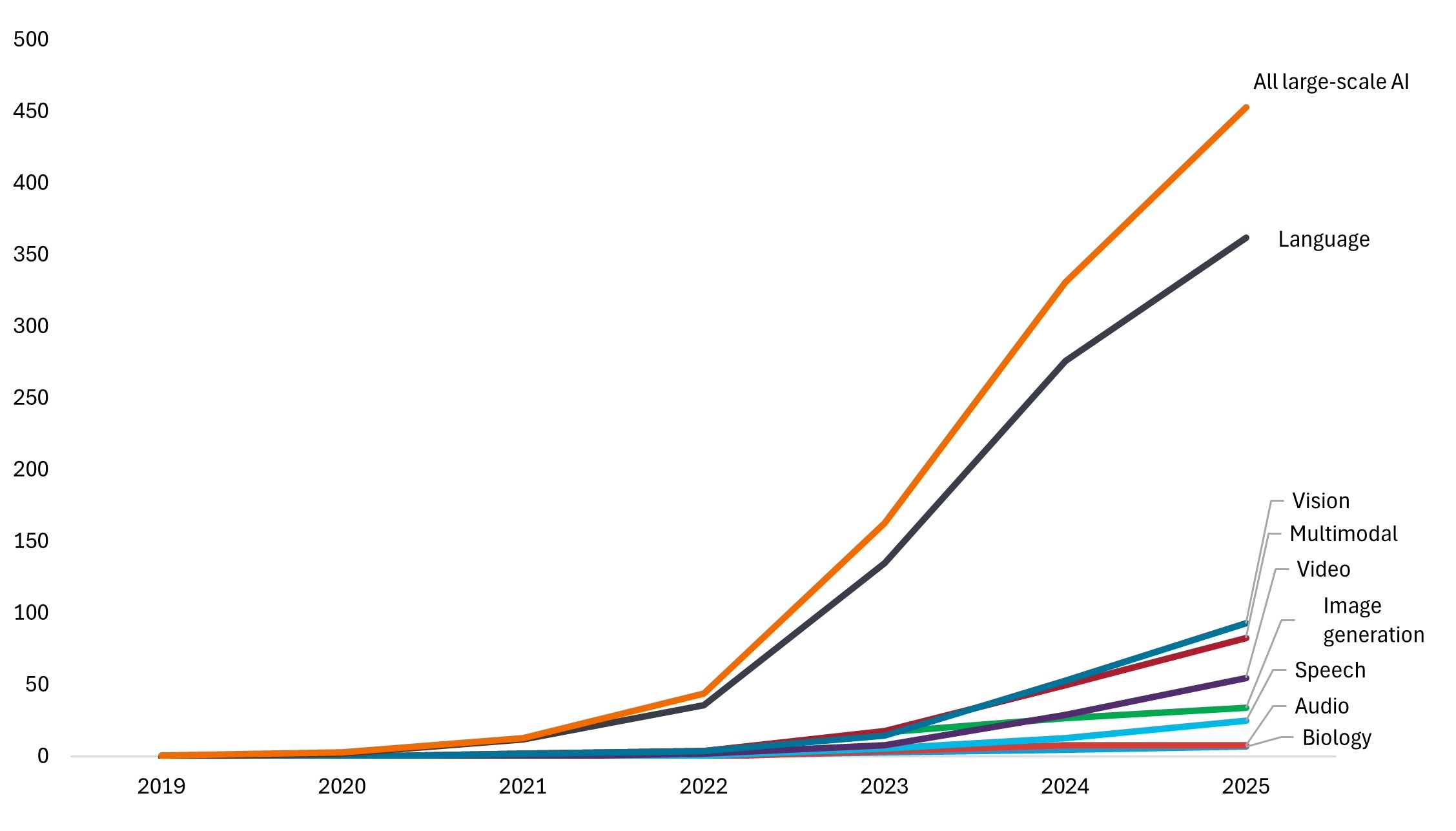

Several years ago, we talked about “big data” and the promise of machine learning, algorithms that could learn relatively simple, repetitive tasks. Large language models (LLMs) and AI are perhaps the ultimate realization of that process. The world is currently generating approximately 30 terabytes of new data every second,1 and roughly 90% of the world’s information has been created within the last two years.2 Additionally, there has been a sharp acceleration in the release of large-scale models since 2022 (Exhibit 1).

Source: Epoch (2025), Our World in Data, as at 12 March 2025.

Source: Epoch (2025), Our World in Data, as at 12 March 2025.What’s your outlook on the U.S. consumer in the current market environment?

The consumer has shown remarkable resilience. While we’re seeing some normalization in spending patterns, the underlying health appears solid. Here’s a key data point that doesn’t get enough attention: Household debt-to-asset ratios are at 50-year lows, which means U.S. households are in a stronger financial position than many investors appreciate (figure 2).

Figure 2: Debt-to-asset ratio for U.S. households

Source: Federal Reserve. As of 30 June 2025.

Source: Federal Reserve. As of 30 June 2025.

Even in recent months, what we’re hearing from companies almost universally is that business is still pretty good. Consumer sector earnings broadly exceeded expectations in the second quarter.

Tariffs remain a wild card as we discussed. We’re watching carefully how consumer behavior responds to price increases. So far, we haven’t seen major demand destruction, but it’s still early.

1 Source: Demand Sage. Big Data Statistics 2025. 24 June 2025.

2 Source: Rivery. Big data statistics: How much data is there in the world? 28 May 2025.

Volatility measures risk using the dispersion of returns for a given investment.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.