A new year often brings change, and 2026 is no exception. As advisors revisit financial plans with clients, there are several key changes resulting from legislation that will be important to consider. These tax provisions and savings opportunities provide financial professionals with an opportunity to have deeper planning conversations with clients and help ensure they’re on track to meet their long-term goals.

1. Charitable contributions for non-itemizers

Whether it’s supporting their child’s school, their house of worship, or their public radio station, many Americans are charitably inclined. For years, all this support led to little in the way of tax benefits, especially for those families that didn’t make large enough charitable contributions to itemize their taxes.

A welcome change arrives with the 2026 tax year: Non-itemizers can now claim a deduction for cash contributions to charities. This deduction is limited to $2,000 for those married filing jointly (MFJ) or $1,000 for single tax filers, and there are no adjusted gross income (AGI) limitations. This permanent provision will be an above-the-line deduction, so taxpayers will be able to claim it and then use the standard deduction when filing their taxes.

2. Car-loan interest deduction (aka, new deduction smell)

Those taxpayers who may be buying a new car in the next few years may be able to deduct some if not all the interest they pay on the car loan. For tax years 2025-2028, if the new vehicle (car, van, motorcycle, etc.) weighs under 14,000 pounds, is assembled in the U.S., and isn’t being leased, interest on the loan up to $10,000 may be deducted. However, unlike the charitable deduction, this deduction will be phased out as AGI increases (between $200,000-$250,000 for MFJ and $100,000-$150,000 for single taxpayers).

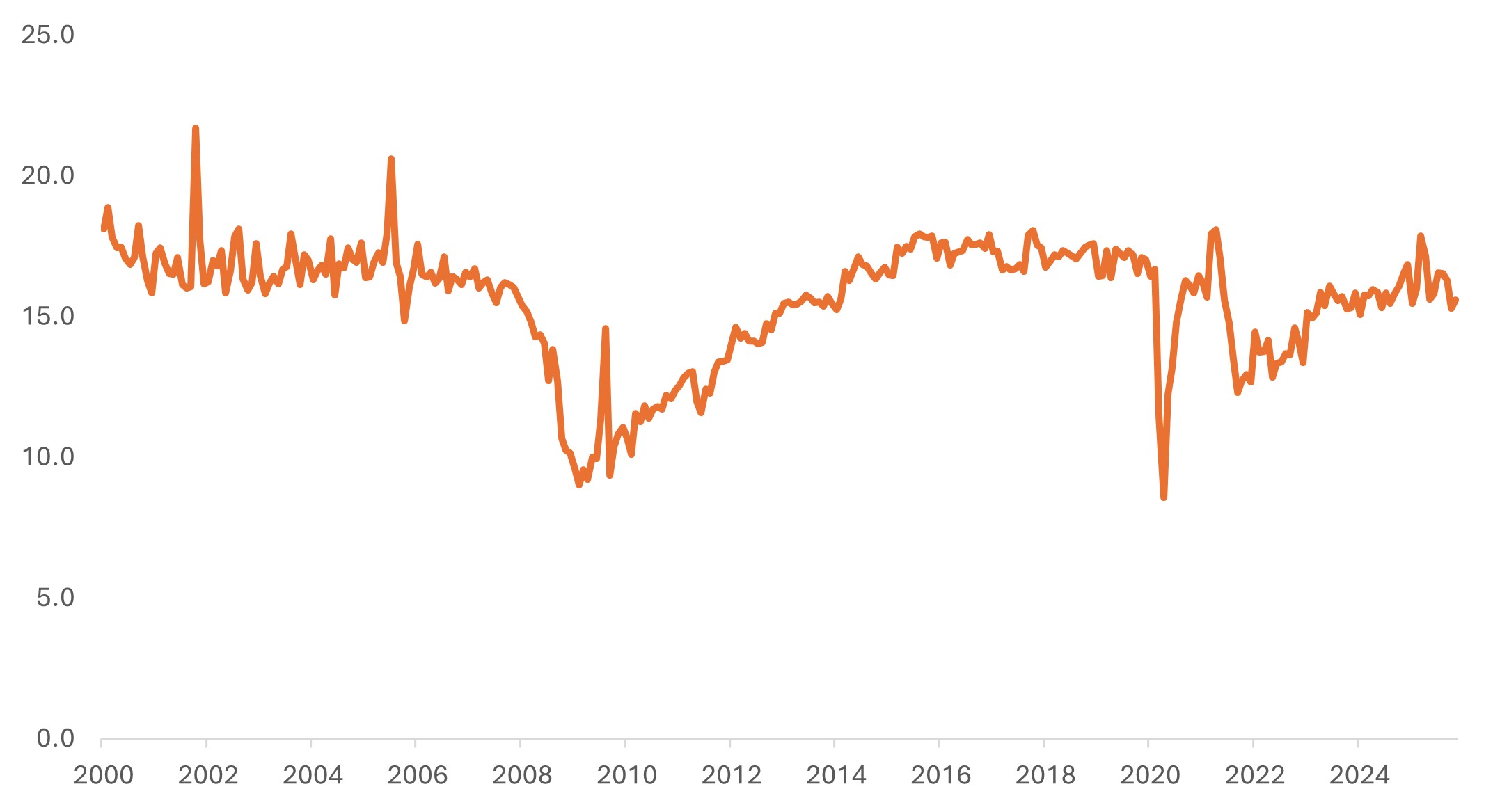

Lightweight vehicle sales: Autos and light trucks, millions of units

Over the past 25 years, Americans have bought 15.5 million new cars and trucks per year.

Source: Federal Reserve Economic Data, Federal Reserve Bank of St. Louis.

While this change shouldn’t send people straight to the dealership to buy a new car, it does mean that if you need and can afford a new car, there will be some added tax benefit that goes along with that new car smell.

3. Newly eligible 529 Plan expenses

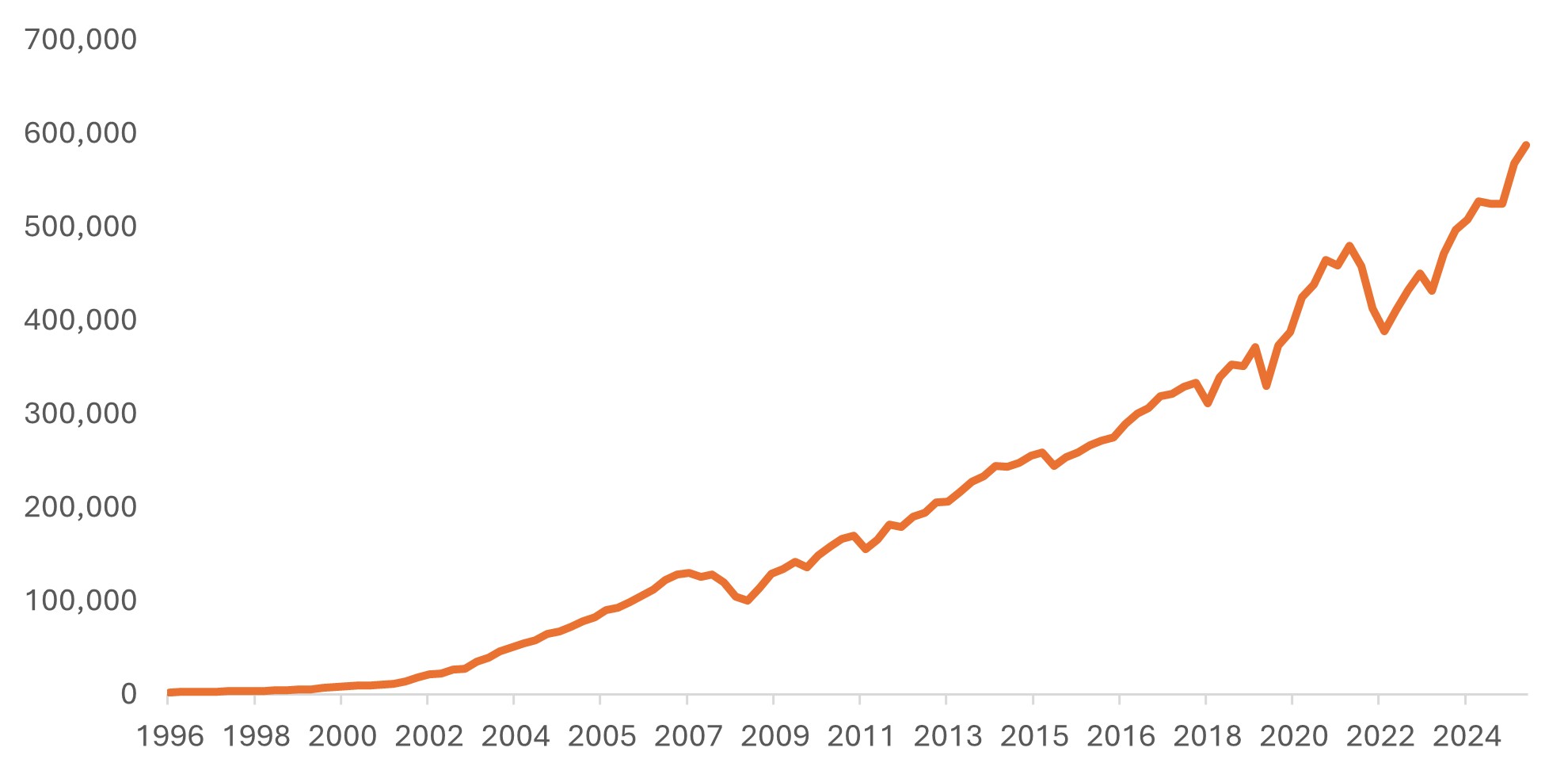

For the nearly $600 billion currently invested in 529 plans1, those dollars may now be used for two new categories of expenses that can be paid tax-free.

Households and nonprofit organizations; assets in 529 plans, level, millions of U.S. dollars

First, 529 assets can now be used for up to $20,000 (up from $10,000) per year of K-12 related expenses. You may remember that, based on the Tax Cuts and Jobs Act, 529 plans were permitted to be used not only for college expenses but also K-12 expenses.

Second, 529 assets may now be used for expenses related to obtaining or maintaining a qualified post-secondary credential, such as the CFP designation. This is a wonderful change for adults who may want to gain further expertise in their chosen fields and for those with 529 accounts that may have leftover assets after children have graduated from college.

These updates to the rules surrounding 529 plans continue to make them great financial planning tools, not only for the funding of education, but since up to $35,000 can be rolled over tax-free into a Roth IRA, for the funding of retirement as well.

4. Trump Accounts: A new savings vehicle for young Americans

Along with the changes to 529 account expense eligibility, the One Big Beautiful Bill Act (OBBBA) introduced another savings vehicle for young Americans. Trump Accounts, which will become available on July 4, 2026, provide an opportunity to open a new savings account for children under age 18. Once opened, these accounts can be funded with after-tax contributions up to $5,000, plus employer contributions up to $2,500 (not counted toward the $5,000 limit). Once the child turns 18, distributions can begin and follow IRA rules. As an added bonus for those who have/had a child in 2025–2028, through its pilot program, the federal government will contribute $1,000 for U.S. citizens born during this period.

While Trump accounts may not have all the flexibility and benefits of a 529 account, for example, they do offer another option to help young people start saving and investing. Based on the timeline and recently released IRS guidance, it is important for advisors to educate clients on these and other options to ensure investors’ goals are understood and matched with the right savings vehicle.

5. New limits on student loan borrowing

Another change coming about via the OBBBA impacts federal student loan borrowing. Starting July 1, 2026, the OBBBA establishes new federal student loan limits. The legislation creates a $257,500 total lifetime cap across all federal loans (excluding Parent PLUS) and phases out Grad PLUS loans. Parent PLUS loans are capped at $20,000 per year and $65,000 lifetime per child, while graduate borrowing is limited to $100,000 total for most master’s programs and $200,000 for professional degrees such as law or medicine. Along with that, repayment plans will default to a balance-based standard repayment plan, with repayment terms that range from 10 to 25 years, depending on how much is owed.

These changes should prompt clients with children to consider their education funding plans. It may also change the calculus for families with students who will be graduating in the near future regarding repayment and financial support.

6. Roth catch-ups for “high earners”

The final change that will have far-reaching implications was introduced under SECURE 2.0. This provision, which is now in effect, will require “high earners” who are age 50 or older (by December 31, 2025) in retirement plans to make catch-up contributions on a Roth, after-tax basis. High earners are defined as those who earned more than $150,000 in FICA wages in the prior year.

There are a number of issues and questions that this provision raises for clients, advisors, payroll providers, plan sponsors/business owners, and recordkeepers. For clients, the main questions to answer are:

- Does my retirement plan offer a Roth 401(k)? If it doesn’t, you won’t be able to make a catch-up contribution.

- How much should I contribute to pre-tax versus after-tax buckets? It may make sense to consider how your tax rate changes year after year.

- How should assets in these growing pools of after-tax assets be allocated? Proper asset location (putting the right types of assets in the right types of accounts) may affect after-tax alpha.

I covered the Roth catch-up contribution changes in greater detail in a recent article.

All these changes, as well as others, provide an opportunity to discuss both short-term and long-term financial planning strategies with clients. Although certain provisions may involve small amounts, these details can help advisors start broader discussions with clients that may help create a relationship with a prospect or deepen a relationship with an existing client.

Please reach out to your Janus Henderson representative if you would like to receive the latest edition of Wealth Planning Trends, and subscribe to our wealth management subscription for the latest insights.

1 Federal Reserve Economic Data, Federal Reserve Bank of St. Louis.