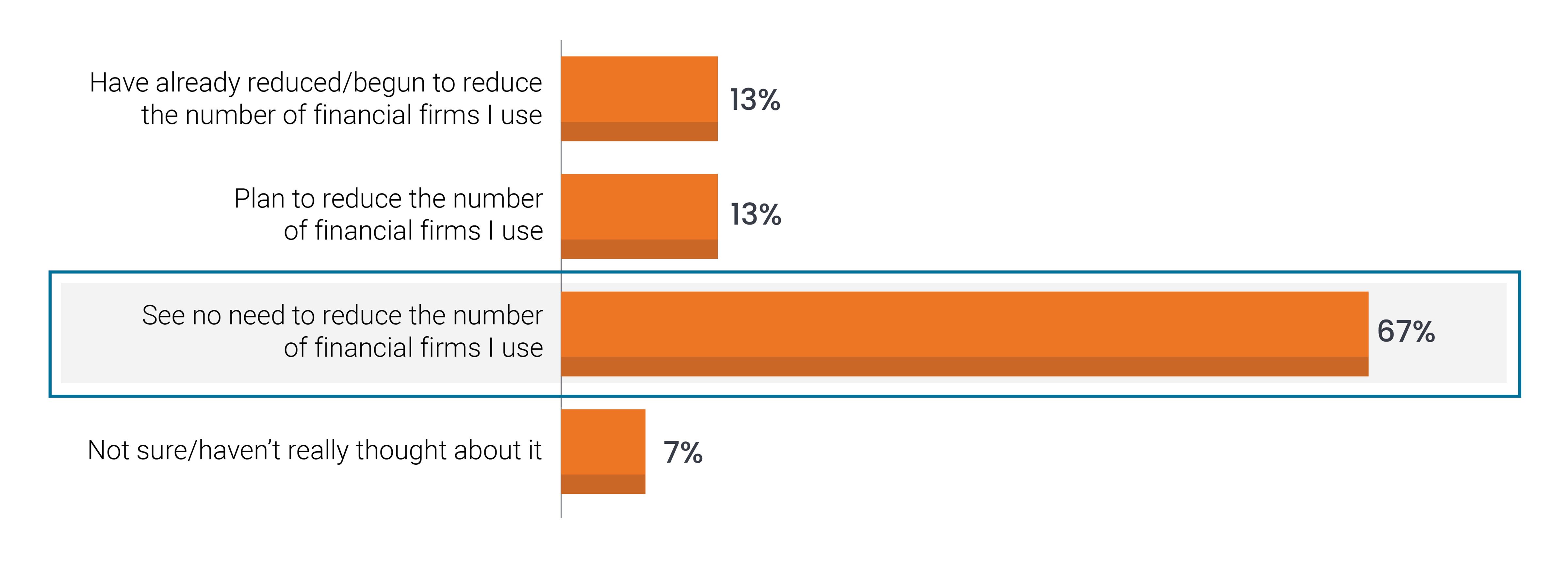

The 2025 Janus Henderson Investor Survey reveals a striking trend: 89% of affluent investors work with multiple financial advisors or institutions, and 67% see no reason to consolidate.

If nearly 9 in 10 affluent investors work with multiple advisors, what does that say about trust, value, and opportunity in wealth management today?

For financial professionals, this fragmentation presents both a challenge and an opportunity.

Plan for maintaining financial firm relationships during retirement

Understanding the investor mindset

Comfort and peace of mind are paramount for investors nearing or in retirement. Many retirees hold significant cash reserves – 57% of respondents to our survey reported having over a year’s worth of expenses in cash – and prefer dividend-paying stocks for income. These choices reflect a desire for stability, not necessarily optimization.

So, why the reluctance to consolidate? There are a few common reasons:

Emotional comfort: Investors feel safer spreading their assets across institutions.

Perceived diversification: Many equate multiple accounts with better diversification.

Lack of urgency: Like many things in life, investors look at their advisor relationships and say, “If it ain’t broke, there’s no reason to fix it.”

Advisor action steps

Rather than pushing for consolidation outright, advisors can position themselves as indispensable by offering services that align with investor psychology and retirement needs. Advisors who do this effectively can incrementally increase wallet share and deepen client relationships.

1. Streamline cash flow across accounts

Multiple advisors mean multiple accounts. While investors may not want to consolidate advisor relationships, they should understand the value of consolidating cash flows, especially in retirement. This reduces complexity and allows for better tracking of spending, helping clients adhere to their retirement income plans.

2. Educate clients on true diversification

Multiple accounts don’t always equate to diversified portfolios. Advisors can educate clients on the difference between account quantity and asset quality, helping them achieve real diversification across their household holdings.

3. Highlight retirement income planning

Our survey found that nearly 80% of advised investors have a retirement income plan, but 73% said that they were very or somewhat concerned about how volatility might affect their ability to generate retirement income. This highlights the importance of sustainable, inflation-adjusted cash flow strategies and spending adjustments. Advisors who specialize in this area can differentiate themselves meaningfully.

4. Integrate financial and personal wellbeing

Investors increasingly value holistic advice. By offering guidance on both financial and personal wellbeing, advisors may gain access to more of a client’s “serious money” and deepen the relationship.

Bottom line

Advisors who meet investors where they are—emotionally and strategically—can build trust, simplify complexity, and potentially consolidate influence, even if not assets. Those who embrace this mindset won’t just grow wallet share—they’ll become the primary source of financial confidence for their clients.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.