The securitized market, worth $15.3 trillion, offers investors significant opportunities

Explore each of the U.S. Securitized Markets to learn the characteristics of each asset class

Agency MBS

Mortgage-Backed

Securities

Agency MBS

Mortgage-Backed Securities

Agency MBS are issued or guaranteed by one of three government or quasi-government agencies: Fannie Mae, Freddie Mac, and Ginnie Mae. Because of this government support, the credit risk within agency MBS is considered negligible, similar to U.S. Treasuries.

Learn moreCMBS

Commercial Mortgage-

Backed Securities

CMBS

Commercial Mortgage-Backed Securities

CMBS are collections of commercial mortgage loans issued by banks, insurers, and alternate lenders to finance purchases of commercial real estate, such as office, industrial, retail, hospitality, and multi-family. CMBS structures help link the financing needs of real estate buyers with investors' capital.

Learn moreCLO

Collateralized Loan

Obligations

CLO

Collateralized Loan Obligations

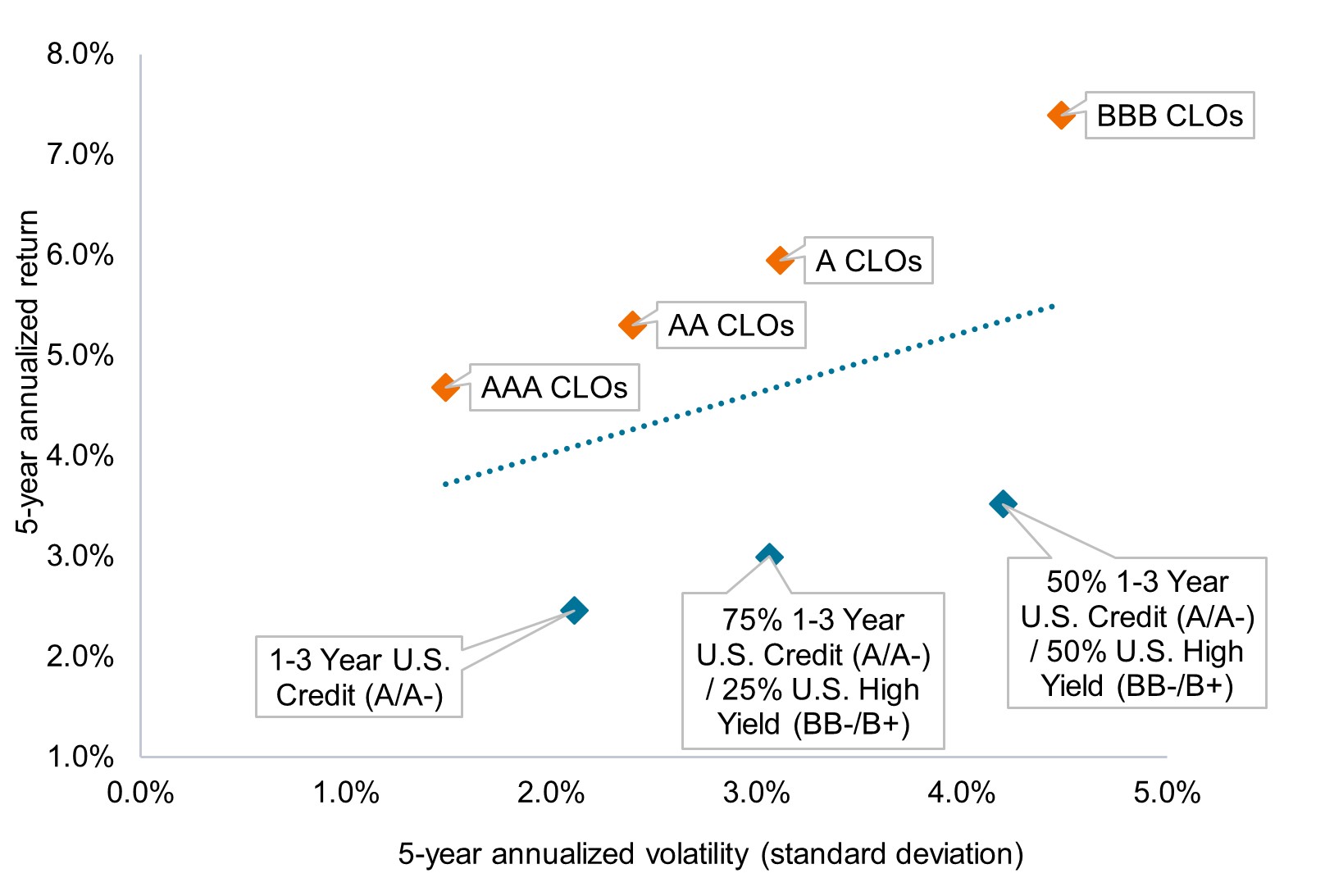

CLOs are managed portfolios of bank loans that have been securitized into new instruments of varying credit ratings. CLOs have increasingly become the link between the financing needs of smaller companies and investors seeking higher yields.

Learn moreABS

Asset-Backed

Securities

ABS

Asset-Backed Securities

ABS are built around pools of similar cash-flowing assets that include auto loans, credit card receivables, and student loans, all of which grant investors exposure to the consumer credit market.

Learn moreRMBS

Residential Mortgage-Backed

Securities

RMBS

Residential Mortgage-Backed Securities

RMBS are created by private entities and do not carry a guarantee from a government agency. RMBS are typically comprised of residential mortgages that are unable to meet the criteria to qualify as agency loans.

Learn moreMeet the Janus Henderson team behind our success in securitized markets

2nd

fastest-growing actively managed fixed income ETF provider for taxable bond ETFs

4th

largest active fixed income ETF provider by AUM*

$64.5B

in firmwide securitized assets

as of December 31, 2025

*Source: Morningstar Asset Flows Data as of December 31, 2025

Benefits of having securitized assets in your portfolio

Diversify risk exposures

Securitization can reduce idiosyncratic credit risk by providing exposure to thousands of underlying loans.

Manage duration & improve credit quality

The addition of securitized assets provides an opportunity to dampen overall portfolio duration and increase average credit quality compared to The Bloomberg U.S. Aggregate Bond Index (the Agg).

Access better yield opportunities

Securitized assets may offer higher yields than alternative options of similar or equal credit quality.