Quarterly Update

The investment team recap this quarter.

(Note: Recorded in January 2026).

30 YEAR HISTORY OF

Providing S&P 500®-Like Returns with Significantly Less Volatility

Fund Highlights

- High-conviction large-cap growth equities paired with an active intermediate-term bond strategy

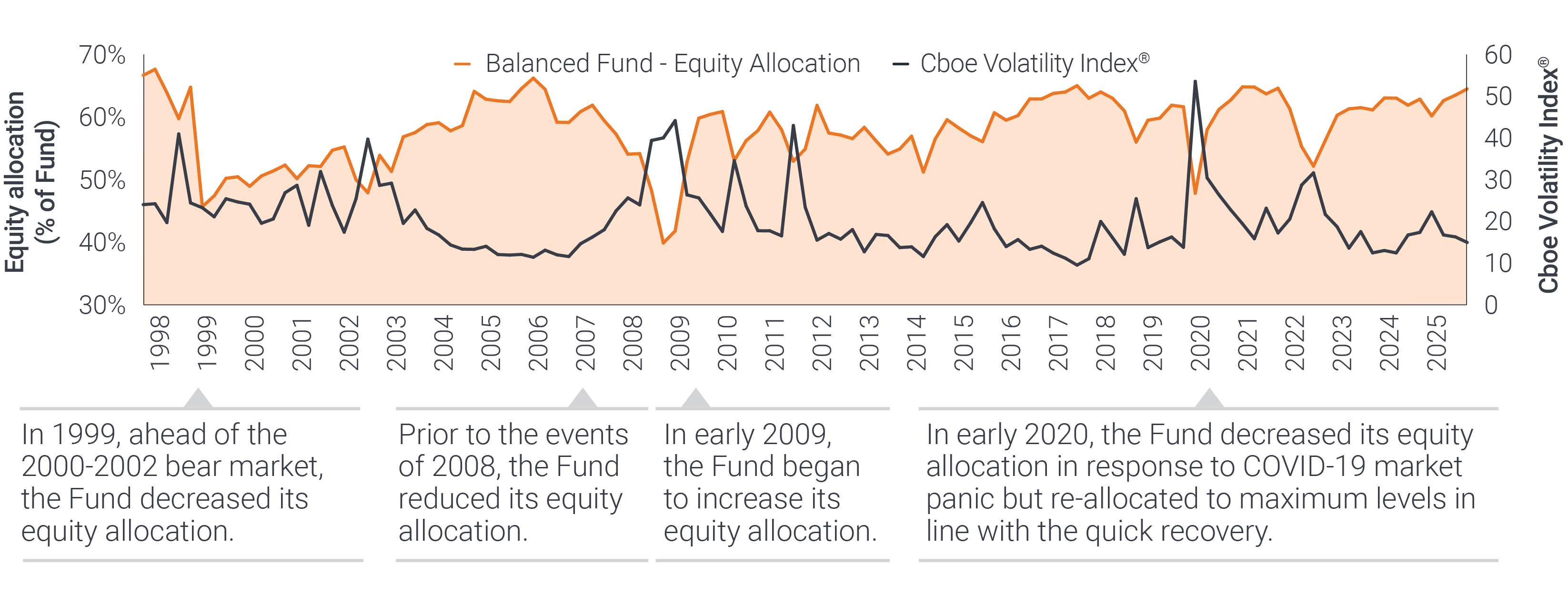

- Dynamic asset allocation approach that migrates between 35%-70% equity depending on market conditions

- Integrated research allows our equity and fixed income analysts to work side by side covering the same global sectors

Equity allocation adapting to market changes

Cboe Volatility Index® or VIX® Index® shows the market’s expectation of 30-day volatility. It is constructed using the implied volatilities of a wide range of S&P 500® index options and is a widely used measure of market risk. The VIX Index volatility methodology is the property of Chicago Board of Options Exchange, which is not affiliated with Janus Henderson.

As of 12/31/25, Balanced Fund Class I Shares Morningstar Ratings™ in the Moderate Allocation category: 4 stars out of 464 funds, 4 stars out of 444 funds, and 5 stars out of 370 funds, for the 3-, 5-, and 10-year periods, respectively.