Quarterly Update

The investment team recap this quarter.

(Note: Recorded in January 2026).

JHI

About this ETF

Why Invest in this ETF

High-Quality Asset Class

A robust asset class during uncertain times, AAA-rated CLOs have endured through the Global Financial Crisis and the COVID-19 pandemic, eliciting growth in the CLO market.

Risk Management

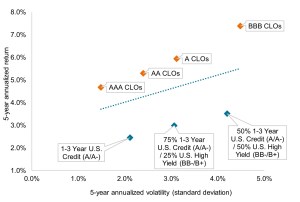

AAA-rated CLOs may help diversify a traditional fixed income portfolio, while exhibiting low volatility and low downgrade risk.

Efficient ETF Structure

Provides exposure to AAA-rated CLO markets historically available only to institutional investors with the lower cost, transparency, and liquidity characteristics of the ETF structure.

RATINGS AND AWARDS

*Designations

Understanding Collateralized Loan Obligations (CLOs)

A combination of key characteristics makes CLOs a compelling

option for today’s investors. Portfolio Manager Jessica Shill explains

how CLOs work, their potential benefits and the active management

strategies employed to navigate the complex market.