Subscribe

Sign up for timely perspectives delivered to your inbox.

The Portfolio Construction and Strategy Team discusses how the flexibility and diversification of multi-sector bond strategies can help fixed income investors manage risk as market volatility evolves.

This article is part of the latest Trends and Opportunities report, which seeks to provide therapy for recent market shocks by offering long-term perspective and potential solutions.

Flexible multi-sector bond strategies may help investors “average in” to higher yielding opportunities, while at the same time allowing them to remain nimble

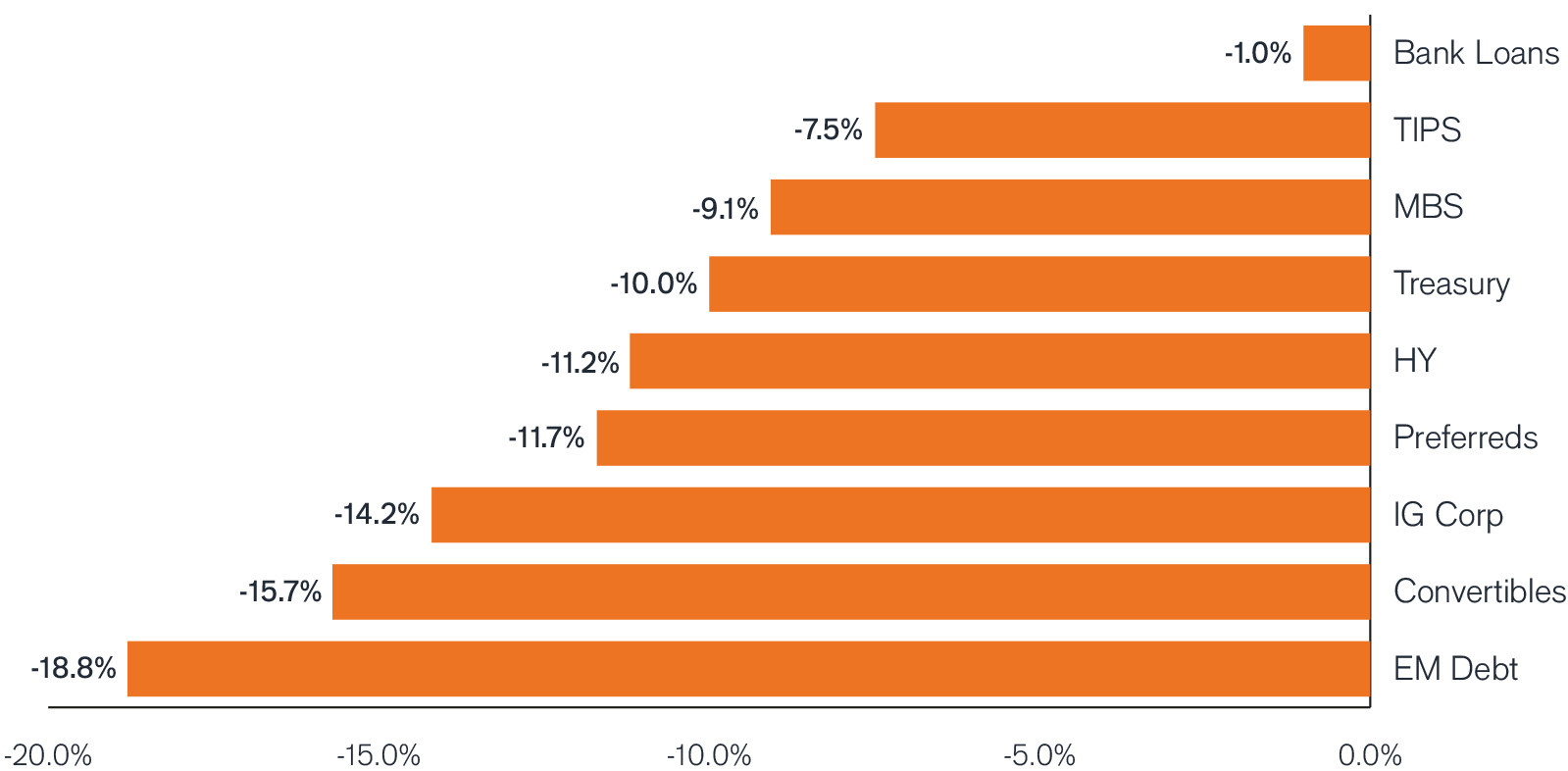

Source: Morningstar as of 8/31/22. S&P/LSTA US Leveraged Loan TR, Bloomberg US Treasury US TIPS TR USD, Bloomberg US MBS TR USD, Bloomberg US Treasury TR USD, ICE BofA Fxd Rate Pref TR USD, Bloomberg US High Yield Corporate TR USD, Bloomberg US Corp Bond TR USD, ICE BofA US Convt Bonds TR USD, JPM E

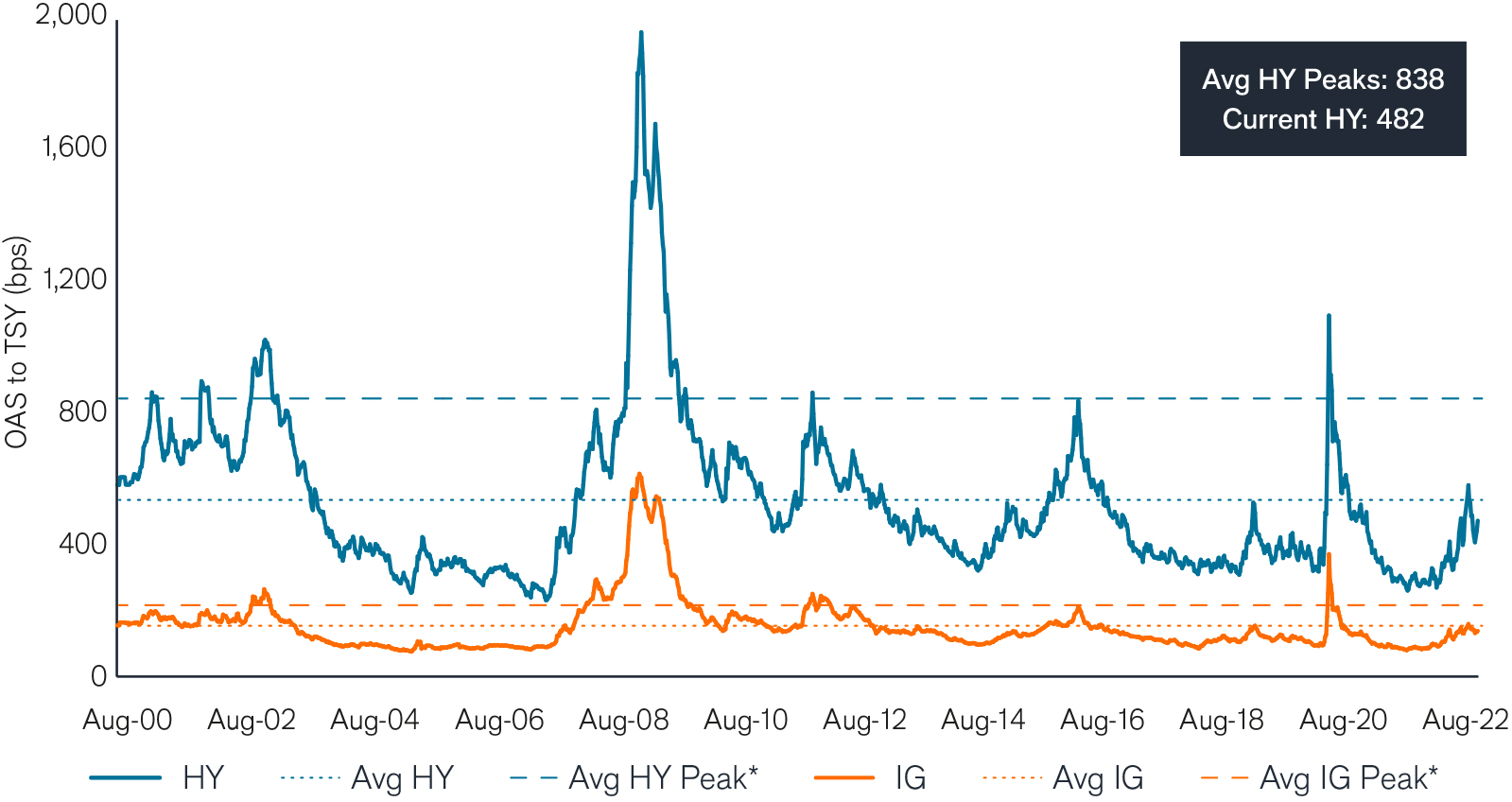

Source: Bloomberg as of 8/31/22. *Avg Peak spread levels exclude ’08 and ‘20 selloffs