- Products

-

-

Explore our differentiated and actively managed ETFs

-

- Capabilities

-

- Insights

-

-

- Market GPS

Investment Outlook 2026

-

-

- Resources

-

-

2025 Investor Survey

Discover how high-net-worth investors are planning for the future

-

- Who we are

-

-

About us

-

Our people

-

Brighter Future Project

-

-

-

We provide access to some of the industry’s most talented and innovative thinkers.

Meet our teams

-

The Brighter Future Project is an innovative initiative that combines wealth and purpose through investments and charitable actions, including DEI and Responsibility.

Explore the Brighter Future Project

-

-

-

Portfolio Construction and Strategy

Empowering you to perform at a higher level

Our Portfolio Construction and Strategy Group is designed to help you keep your clients on track while giving you a distinct competitive advantage. Ongoing, 100% objective, forward-looking portfolio consulting, customised to work with you based on a singular purpose: helping your clients achieve their goals.

We elevate your portfolio management process through:

Portfolio Deconstruction

KNOW EXACTLY WHAT’S GOING ON AND WHY IN YOUR PORTFOLIOS

Custom portfolio diagnostics

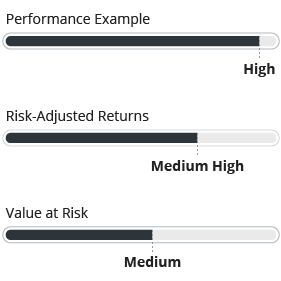

Our analyses deliver a deep and dynamic view of portfolio risk far beyond traditional style boxes, which seek to accelerate risk mitigation and maximise performance. Through metrics such as VaR, downside and max drawdown analyses, risk budgeting, correlation analysis and factor return decomposition, we aim to help navigate volatility and find pockets of potential performance.

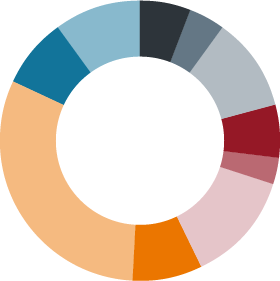

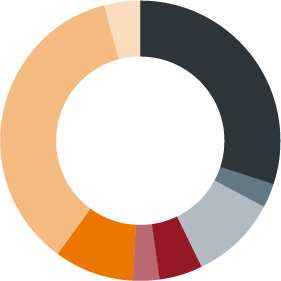

Sample client model portfolio allocation

Sample custom benchmark allocation

Custom diagnostic scorecard:

Client model vs. Benchmark

Portfolio Construction

MAKE DISCIPLINED, INFORMED INVESTMENT DECISIONS THAT INSTILL CLIENT CONFIDENCE

A unique lens into risk-based asset allocation

Our proprietary database of thousands of model portfolios on which we’ve consulted gives us a unique perspective on your asset allocation. These observations are summerised in our proprietary asset allocation lens, which simplifies and categorises our fundamental views across asset classes. This allows us to distill our portfolio construction work into a straightforward, forward-looking process that focuses on your clients’ goals.

Portfolio Knowledge Exchange

BROADEN YOUR PERSPECTIVE BY EXPLORING DIFFERENT OPINIONS ACROSS THE INVESTMENT UNIVERSE

Portfolio diagnostics reports

Our insights and opinions on issues, trends and opportunities by asset class help test and shape your perspective.

Related insights

An experienced team of professionals

A select team of highly specialised strategists with deep experience and expertise, gained from thousands of custom analyses and models.

Global Head of Portfolio Construction and Strategy

Senior Portfolio Strategist

Senior Portfolio Strategist

Portfolio Strategist

It's On Us, But Not About Us

100%

COMPLIMENTARY

Enjoy the benefits of sophisticated, expert portfolio analysis without the overhead

100%

PRODUCT AGNOSTIC

Our focus is entirely on you and your portfolios

Engage With Us

Contact your Janus Henderson sales director at 800.668.0434 and ask about our Portfolio Construction consultations.