ABOUT THIS FUND

This fund of funds offers broad global diversification for investors by utilizing the full spectrum of Janus Henderson’s investment expertise and solutions, with the goal of providing higher risk-adjusted returns than the broader markets.

WHY INVEST IN THIS FUND

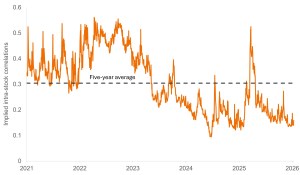

Actively Managed Diversification

This fund actively allocates across a range of actively managed equity, fixed income and alternative asset classes while providing opportunity for higher returns and lower volatility through the benefits of diversification.

Powered by Janus Henderson’s Investment Expertise

The Portfolio Managers select from the full range of our investment groups’ expertise to build this portfolio, allowing for more complete diversification across investment styles, geographies and asset classes.

Defined Risk

Targeting an allocation of 70% to 85% equities, 10% to 25% fixed income, and 5% to 20% alternatives, this fund may be suitable for growth investors desiring a well-diversified portfolio that seeks to exceed the long-term returns of broad markets.