About this ETF

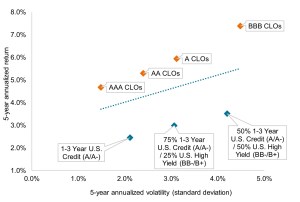

For investors seeking high current income with a secondary focus on capital appreciation. JIII aims to generate higher yields than those of standard core-plus portfolios and greater diversification than single-sector, high-yield strategies.

Why Invest in this ETF

Our Team

Culture of collaboration, global integration, and respectful challenge with a research-first mentality

Disciplined Risk Budgeting

Disciplined investment process targets repeatable performance by dynamically allocating around our starting point, the Strategic Asset Allocation (SAA)

High Conviction

Bottom-up idea generation across a diverse set of return sources, seeking to opportunistically enhance yield per unit of risk