Le perturbazioni energetiche, e non la geopolitica, stanno guidando i mercati emergenti, poiché l'aumento dei prezzi dell'energia potrebbe ridefinire i vincitori e i perdenti. Il persistere di prezzi più elevati determinerà l'impatto finale.

Approfondimenti

Le nostre ultime riflessioni sui temi che caratterizzano l'attuale scenario d'investimento. Aggiornamenti puntuali, rubriche trimestrali e analisi approfondite, direttamente dai nostri esperti.

Una reazione precoce agli attacchi militari in Iran e le implicazioni per gli investitori.

Tra i punti salienti dell'ultima riunione sugli utili trimestrali di NVIDIA, la società ha citato il 2026 come un punto di svolta per l'AI agentica, che traina l'aumento della domanda di elaborazione e della generazione di ricavi.

Quando le strategie tradizionali sulle commodity non sono all'altezza, in che modo le strategie alternative possono sbloccare opportunità più ampie e più resilienti?

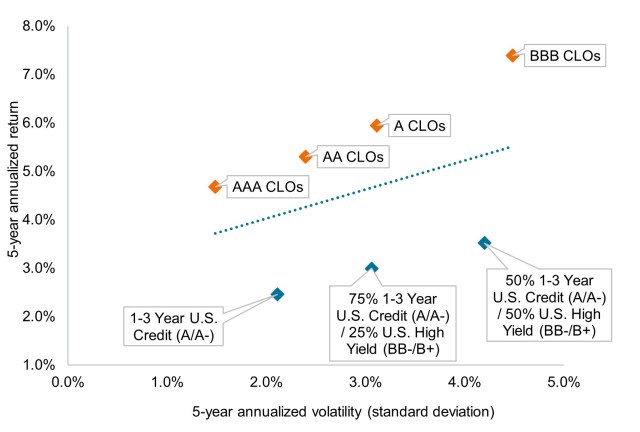

Negli ultimi cinque anni, le Obbligazioni garantite da collaterale (CLO) hanno generato alcuni dei migliori rendimenti corretti per il rischio disponibili sui mercati obbligazionari.

Per avere una prospettiva sulla recente volatilità, riteniamo che gli investitori debbano comprendere l'entità della trasformazione dell'AI e il modo in cui avrà invariabilmente un impatto su ogni settore aziendale

Ali Dibadj con Luke Newman e Robert Schramm-Fuchs per discutere delle prospettive di investimento, dei rischi e delle opportunità sottovalutate dell'Europa.

Tre elementi essenziali da considerare per una strategia bilanciata efficace, oltre alle tendenze da tenere d'occhio per le azioni e l'obbligazionario nel 2026.

L'Europa deve affrontare delle sfide, ma il crescente slancio delle riforme e i venti strutturali di coda stanno ridisegnando le sue prospettive di investimento.

Esploriamo la dispersione nel mercato dei prestiti.

L'ampia dispersione nel 2026 sta creando un contesto favorevole per investimenti selettivi nelle small cap globali.