The U.S. Supreme Court’s ruling on President Trump’s tariffs may be welcomed by markets but investors must now decipher a host of adjacent issues.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

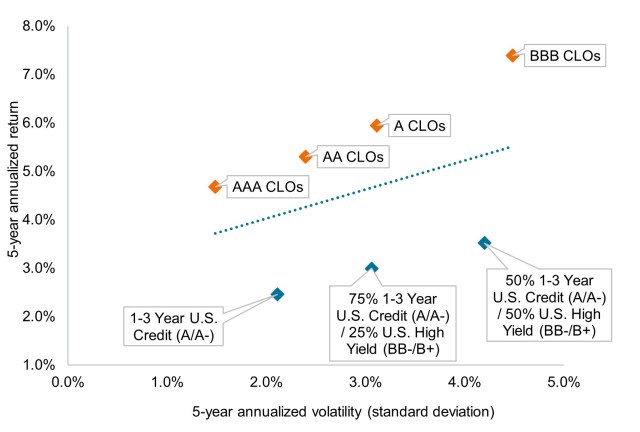

Over the past five years, collateralized loan obligations (CLOs) have delivered some of the best risk-adjusted returns available in fixed income markets.

To gain perspective on recent volatility, we believe investors need to understand the magnitude of the AI transformation and how it will invariably impact every corporate sector

Ali Dibadj joins Luke Newman and Robert Schramm-Fuchs to discuss Europe’s investment outlook, risks, and underappreciated opportunities.

Kevin Neuhart, Executive Director, Lead – Retirement Sales Strategy, and Taylor Pluss, Defined Contribution Specialist, discuss how actively managed strategies can strengthen core defined contribution (DC) menus and improve participant outcomes.

Three essential elements to consider for an effective balanced strategy, plus trends to watch in equities and fixed income in 2026.

Why the market may be overpaying for growth, and how a shifting market structure creates both risks and opportunities for fundamental investors.

As more assets flow into Roth accounts due to SECURE 2.0, advisors have an opportunity to potentially improve clients’ after-tax results through thoughtful asset location.

Exploring the dispersion in the loan market.

How interest rates, AI trends, and evolving policy dynamics are influencing the outlook for the energy and financial sectors.

After attending the sector’s flagship conference, we come away with strengthened conviction in the constructive backdrop shaping healthcare in 2026.